-

With annual revenues of $1.8 billion and 3,500 employees, Solenis is the leading global supplier of specialty chemicals and services for process, functional and water treatment applications.

With annual revenues of $1.8 billion and 3,500 employees, Solenis is the leading global supplier of specialty chemicals and services for process, functional and water treatment applications.

Classic carve-out investment in a market-leading supplier of specialty chemicals and related value-added services with significant opportunities to enhance its market position and improve profitability as a standalone company.

CD&R developed a strong relationship with Ashland Inc. over a five year period and in mid-2013 held strategic discussions with the company’s senior management about a potential carve-out of its non-core business unit, Ashland Water Technologies (AWT). Subsequently in the fall of 2013, an activist public shareholder began pressuring Ashland’s board of directors to streamline its business portfolio, and the catalyst for a potential transaction was born. CD&R’s familiarity with

the business, expertise in the chemicals industry and with service-driven business models and track record of successful, complex carve-out transactions ultimately positioned CD&R as the preferred buyer. In July 2014, CD&R acquired AWT in a $1.8 billion transaction, at which time the company was rebranded and now operates under the name Solenis.

Company Profile

With annual revenues of $1.8 billion and 3,500 employees, Solenis is the leading global supplier of specialty chemicals and services for process, functional and water treatment applications. The company has a global footprint with 30 manufacturing facilities (primarily light blending) located in 17 countries across 5 continents. Similar to CD&R Fund VIII’s 2009 investment in Diversey, Solenis is characterized by its service intensive business model, as the company’s 1,200+

-

Key Achievements

- Separation from Ashland progressing well - expected completion by end of 2015

- Re-energized organization and added new talent at key functional senior positions

- Management team is actively working to execute on key operating and strategic initiatives to drive top-line growth and profitability expansion

- Early progress on reducing net working capital

- In February 2015, Solenis acquired Clearwater Chemicals, a tuck-in acquisition of a family-owned specialty chemicals company focused on the tissue & towel markets

highly trained sales technicians are often located on-site at customers’ facilities, offering customized solutions and maintaining key customer relationships.

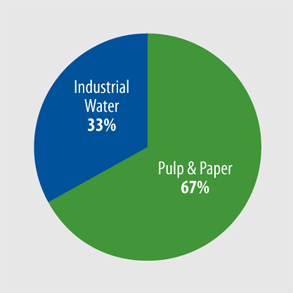

The company’s two primary business segments break down as follows:

- Pulp & Paper (67% of revenue): Solenis provides both functional additives that impact the end-use characteristics of finished pulp and paper products and process additives that improve raw material utilization, increase manufacturing efficiency and reduce costs. In this market segment, the company is the global market leader with approximately 20% market share, and 70% of segment revenue is derived from products for which Solenis has #1 share positions.

- Industrial Water (33% of revenue): Solenis provides water treatment and process chemicals to prevent corrosion, deposition and biological fouling and improve process efficiency. The company currently maintains the #3 (5% share) position in a highly fragmented marketplace, which is growing at 4-5% per annum due to the increasing global scarcity of safe, usable water.

2014 Sales by Segment

2014 Sales by Segment

-

Transaction Overview

In July 2014, CD&R acquired Solenis from Ashland Inc., reflecting the culmination of a multiyear sourcing effort to extract what had historically been a non-core operating subsidiary of Ashland. Fund IX and affiliates invested $405 million for an initial 97% ownership interest. Operating Advisor John Ballbach serves as Chairman of the company.

Value Building Initiatives

The Solenis management team and CD&R have identified several initiatives to improve top-line growth, profitability and efficiency:

- Implement Standalone Structure. Recruiting full corporate team to drive global strategy - CFO, HR, General Counsel, CIO, Controller and Tax/Treasury

- positions all filled. Continuing work to separate from Ashland’s systems and functional operations - should be complete by end of 2015.

- Manufacturing Optimization & Operating Expense Reduction. Rationalizing European plant network due to inefficient cost structure. In-sourcing tolled production to improve capacity utilization and further improve fixed costs. Pursuing additional opportunities including supply chain planning, strategic sourcing and support structure location rationalization.

- Industrial Water Transition. Continuing to refocus Industrial Water segment on Heavy Industry end markets (e.g. hydrocarbon and chemical processing) where Solenis can best compete given its focus on value-added technical solutions and close customer engagement. Upgrading Industrial Water leadership team, as well as sales and account management personnel.

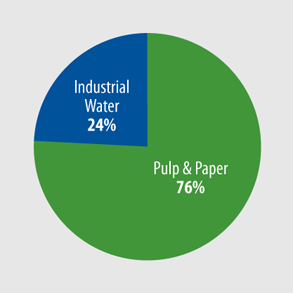

2014 EBITDA by Segment

2014 EBITDA by Segment

-

- Value Documentation, Pricing & Margin Initiatives. Continuing Account Stability Audits to document value add to customers and better demonstrate value of services provided to enable value pricing. Driving enhanced margin management through increased focus on pricing and fixed cost absorption. Improving customer equipment contract execution to be compensated for cost of equipment.

- Growth Initiatives. Driving growth culture through improving sales management processes, including standardizing use of Salesforce.com. Reinvigorating product development and R&D capabilities and pursuing growth opportunities in adjacent products and end markets.

- Working Capital Management. Implementing new discipline regarding working capital. Developing better demand planning capabilities on front-end to drive inventory reduction.

- Strategic Acquisition Opportunities. In February 2015, Solenis closed its purchase of Clearwater Chemicals LLC and Clearwater Specialties LLC (together, “Clearwater Chemicals”), a small tissue & towel specialty chemicals supplier for $89mm or 8.5x LTM 9/30/14 EBITDA (6.8x including est. synergies and 6.2x including the NPV of a tax step-up). The team is currently evaluating additional strategic M&A targets (bolt-ons and transformation deals).

Looking Forward

- The team remains focused on completing Solenis’ separation from Ashland while continuing to deliver strong year-on-year performance in the business.

Investment Characteristics

| Investment Period: | July 2014 - Current |

| Industry: | Specialty chemicals |

| Seller: | Ashland Inc. |

| Purchase Price: | $1.8B |

| Purchase Multiple: | 8.4x LTM 6/30/14 Adj. EBITDA |

| CD&R Equity Investment: | $400M (Fund IX) |

| CD&R Equity Ownership: | 97% (at acquisition) |

| Net Debt to EBITDA (at acquisition): | 6.5x LTM 6/30/14 Adj. EBITDA |

| Operating Advisor: | John Ballbach |

| Status: | Private Unrealized |

| Website: | www.solenis.com |

Summary Financials

| Twelve months ended | ||

| (millions) | 12/31/14 | At Acquisition 6/30/14 |