-

Fully Realized: 2.3x

Rexel’s product offering includes low- and ultra-low-voltage electrical equipment, with a network of approximately 2,300 branches in 38 countries.

Rexel’s product offering includes low- and ultra-low-voltage electrical equipment, with a network of approximately 2,300 branches in 38 countries.

Leveraging scale and superior supply chain execution to deliver strong growth, resilient margins and cash flow across the business cycle

Under the ownership of CD&R Fund VI and Fund VII, Rexel more than doubled sales and profits, expanded its geographic footprint, including increasing its exposure to high-growth markets around the world, developed presence in new product categories that are less sensitive to the economic downturns and recruited a new senior leadership team.

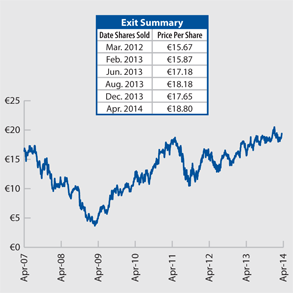

Based on the company’s strong operating performance, Rexel successfully completed an IPO in April 2007 and trades publicly on Euronext Paris under the ticker symbol RXL.

Through a series of block trades, CD&R Fund VI and Fund VII fully realized their investment in Rexel in April 2014 for a collective return of 2.3x original cost.

Company Profile

Headquartered in Paris, Rexel is one of only two global players in the growing market for professional distribution of electrical supplies. The company’s product offering includes low- and ultra-low-voltage electrical equipment, with a network of approximately 2,300 branches in 38 countries. A global leader in the fragmented €168 billion electrical wholesalers’ distribution market, with an estimated market share of 8%, Rexel generates 34% of its sales in North America, 55% in Europe, 9% in Asia-Pacific and 2% in Latin America. The company serves a wide range of contractors and end-users in the residential, commercial and industrial construction and maintenance markets. Rexel’s products are

-

Key Achievements

- Built market leadership positions in developed and emerging markets through organic and external growth

- Executed and integrated transformative acquisitions and strategic add-ons in Europe, U.S. and emerging markets

- Proved resilience of the business model during the economic downturn through continued margin improvements, market-share gains and strong cash generation

- Accelerated push into high-potential business categories linked to energy efficiency and renewables

- Recruited new CEO, new CFO and complemented senior leadership to drive the business to the next level of profitable growth

used in new installations and construction, as well as in the maintenance or renovation of existing installations and buildings. For the full year 2013, Rexel delivered sales of €13.0 billion.

Transaction Background

CD&R’s preparation for Fund VI’s and Fund VII’s 2005 investment in Rexel began a decade earlier with the Firm’s acquisition of WESCO, a market-leading electrical equipment distribution business that delivered 6.1x CD&R’s capital invested. Through CD&R’s WESCO experience and a previous bid for Hagemeyer, a Dutch competitor to Rexel (Rexel itself had attempted to acquire that company in 1998), CD&R successfully positioned itself with Rexel’s former parent, Pinault Printemps Redoute (PPR), to pursue the acquisition of the company. In Rexel, CD&R saw the opportunity to leverage the company’s scale into the United States and emerging markets and improve profitability.

CD&R led the acquisition of a majority stake in Rexel and CD&R Operating Partner Roberto Quarta chaired the company’s Supervisory Board. In light of the size of the transaction, the Firm undertook the €3.9 billion acquisition in partnership with Eurazeo, Merrill Lynch Global Private Equity, Caisse de Dépôt et Placement du Québec and Citigroup Venture Capital. At the time of the transaction, it was the largest ever European public-to-private carve-out transaction.

Prior Success In

Electrical Products DistributionCD&R’s investment in Rexel leveraged the Firm’s prior experience and deep expertise in the electrical products distribution market. CD&R previously owned WESCO, a leading full-line wholesale distributor of electrical products in North America, which the Firm purchased in a carve-out transaction from Westinghouse Electric. Under CD&R’s stewardship and led by CD&R initiatives, WESCO dramatically improved its operating profitability, increasing EBITDA from $4 million at the time of CD&R’s acquisition to $97 million

-

over the four-year period prior to CD&R’s exit. The successful implementation of initiatives at WESCO, including better management of customer profitability, streamlining operations and reducing overhead costs and improving category management, all have been implemented at Rexel to drive significant performance enhancements. In addition to the margin improvements at WESCO, CD&R was able to take advantage of the company’s strong market position to further consolidate the industry through add-on acquisitions, a strategy already proven to be successful at Rexel.

Value Building Strategy

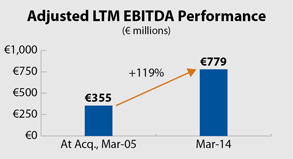

Under CD&R Fund VI and Fund VII’s ownership, Rexel increased its EBITDA by 119% driven by top-line growth and 79bps of margin improvement. The company gained market share as a result of improved sales-force incentives, optimized product category management (including private label), new branch openings, and strategic M&A.

In August 2006, the company completed the transformational acquisition of GE Supply, which propelled Rexel to its number one market position in North America. The Firm’s long-term sourcing strategy proved invaluable as CD&R had been in discussions with GE regarding its Supply division for several years prior to the transaction. After the completion of a successful IPO in 2007, the company acquired Hagemeyer in 2008, the Dutch competitor it had long sought and further solidified Rexel’s market leadership in Europe. Subsequently, against a sluggish macroeconomic backdrop in Europe and North America, the company acquired 25 businesses between

2010 and CD&R’s final realization in April 2014, primarily in the fast growing markets of Brazil, China, India and Peru. Through a series of block trades, CD&R Fund VI and Fund VII fully realized their investment in Rexel in April 2014 for a collective return of 2.3x original cost.

Share Price Performance Since IPO

Share Price Performance Since IPO

Investment Characteristics

| Investment Period: | March 2005 - April 2014 |

| Industry: | Electrical Distribution |

| Seller: | Pinault Printemps Redoute |

| Purchase Price: | $5.3B (€3.9B) |

| Purchase Multiple: | 11.2x LTM Adjusted EBITDA of €355M |

| CD&R Equity Investment: | $508M (Fund VI and VII) |

| CD&R Equity Ownership: | 31% (Sponsors control 85% in aggregate) (at acquisition) |

| Net Debt to EBITDA (at acquisition): | 6.7x |

| CD&R Operating Partner: | Roberto Quarta |

| Status: | Fully realized |

| Website: | www.rexel.com |