-

Partnering with a proven entrepreneur to take the second largest independent petrol station and convenience retail operator in the U.K. to the next level

Motor Fuel Group (“MFG”) is a well-positioned and highly cash generative retail business with stable demand dynamics, limited capex requirements, negative working capital, and strong asset value protection via the Company’s owned real estate. CD&R’s extensive retail experience, including the involvement of former Tesco CEO Sir Terry Leahy, helped to position the Firm to source this transaction through an exclusive partnership with MFG’s current chairman, Alasdair Locke, and the MFG management team. In June 2015, CD&R announced an agreement under which CD&R

Fund IX and affiliates will invest approximately £146 million (~$226 million) to acquire 85% of MFG with the transaction scheduled to close in Q3 2015.

Company Profile

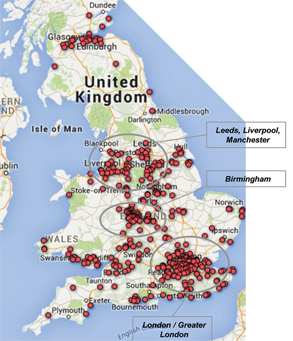

Founded in 2002, MFG has grown to become the second largest independent petrol station operator in the U.K., with a significant presence in the densely populated, higher income areas of the country. The Company currently owns 370 sites across the U.K. and operates through a franchise model in which MFG owns the underlying site real estate and manages the fuel operations (fuel brands include BP, Shell, Texaco and Jet), while the franchisee operates and manages the onsite retail activities through the Costcutter brand. MFG’s business model provides predictable economics due to the stability of re-fueling demand and fuel margins, contractually-set income

-

streams from franchisee fees and product rebates, and the Company’s highly predictable cost base. All of MFG’s sitesare profitable, reflecting the business model’s low fixed-cost base. Most of the site staffing is employed by the franchisee. On a pro forma basis, the Company generated £49.3 million of EBITDA in 2014.

The petrol station industry exhibits historically stable demand and is currently transitioning towards larger, independent operators as the major oil companies are steadily exiting their downstream retail fuel operations. Over the past twelve months, MFG has strategically expanded its operations through the acquisition of 222 sites from Murco Petroleum Ltd, a U.K.–based oil refining company, and the pending acquisition of 90 sites from Royal Dutch Shell, plc, a multinational oil and gas company. The Company also provides fuel logistics services to a network of 220 stations in the U.K. under the Murco brand.

Transaction Background

In June 2015, CD&R announced an agreement to invest approximately £146 million (~$226 million) for an initial 85% ownership interest. CD&R sourced this transaction through an exclusive partnership with MFG’s current chairman, Alasdair Locke, and the MFG management team, who collectively will own approximately 15% of the business post-closing. Pending the completion of customary regulatory approvals, the acquisition is scheduled to close in Q3 2015.

Investment Thesis

CD&R and the management team believe that MFG represents an opportunity to acquire a well-positioned and relatively stable consumer and retail business with opportunities to improve operational execution. More specifically, the key elements of CD&R’s investment thesis are:

The Company currently owns 370 sites across the

The Company currently owns 370 sites across the

U.K. and operates through a franchise model. -

- Leading independent petrol station travel retail operator in the UK. Operating 370 stations, MFG is the second largest independent operator of petrol stations in the U.K. Each station contains a convenience retail outlet operated under the Costcutter brand. The Company’s geographic footprint includes a significant presence in the affluent and densely populated South East region of the U.K., which constitutes a network of high quality sites that compares favorably versus other top independent competitors. None of MFG’s site locations are unprofitable.

- Stable industry undergoing transition favoring the growth of large independents. The Company operates in an industry that exhibits stability of demand, as vehicle refueling largely represents non-discretionary spending. The industry benefits from an improving competitive environment as major oil companies are actively exiting downstream retail operations, the expansion of supermarket forecourts has been played

- out, and large independents are gaining share. In addition, driven by the need for convenience, consumers are increasingly focused on retail offerings, which in turn are forcing station management to transition to operators with more retail expertise.

- Significant operational improvement potential. Given the inorganic growth of the business over the last several years, CD&R believes that MFG offers a number of value creation opportunities to integrate the business and transform it into a best-in-class petrol station and convenience store operator. Key initiatives on that front include: (i) a fuel rebranding strategy toward premium brands, which should result in higher volumes, coupled with the introduction of CRM programs; (ii) more sophisticated fuel pricing initiatives; (iii) expansion of retail space at a large majority of stations; (iv) improved retail execution, including the introduction of new brands and products; (v) portfolio rationalization; (vi) expanded foodservice operations; and (vii) franchise fee optimization initiatives.

- Sizable industry consolidation opportunity. MFG has a history of expanding its footprint through strategic acquisitions, and CD&R believes that strategically adding site locations can create material benefits of scale in terms of supply agreements and central cost savings. Today, oil majors’ focus on upstream activities is leading to a wave of portfolio disposals, which management believes will benefit large, professionally run independent operators seen by the oil majors as trusted partners to represent their fuel brands. In addition, management believes there are more than 4,000 sites in the U.K. operated by approximately 1,000 “mom-and-pop” owners.

- Downside protection through real estate portfolio and high free cash flow generation. The Company owns a portfolio of site locations that is currently valued at approximately £300 million, which reflects a significant presence in London and the South East region of the U.K. CD&R believes there are significant opportunities to dispose of and monetize underperforming sites located in high density areas with residential or commercial development

-

- potential. In addition, the Company’s low fixed operating costs, low capex requirements and negative working capital characteristics drive high free cash flow and mid-teens cash-on-cash returns on CD&R’s equity investment.

- Partnering with an experienced and commercial management team. MFG’s management team is led by Alasdair Locke, a successful oil and gas entrepreneur who founded Abbott Oil Field Supply, an oil field services business that was subsequently sold to First Reserve. The team has significant property and petrol station experience and will own approximately 15% of the business.

- Meaningful upside optionality on exit. The Company’s strong free cash flow characteristics provide attractive cash-on-cash returns, and CD&R believes that MFG’s business mix of fuel/retail operations and real estate could be attractive to a wide range of potential strategic buyers and infrastructure investors, in addition to both public and private markets.

Investment Characteristics

| Investment Period: | Pending |

| Industry: | Consumer/Retail |

| Seller: | Patron Capital |

| Net Purchase Price: | £472 million |

| Purchase Multiple: | 8.5x 2015E PF EBITDA; 9.2x 2015E PF EBITDAX |

| CD&R Equity Investment: | £146 million (~$226 million, Fund IX |

| CD&R Equity Ownership: | 85% (at acquisition) |

| Net Debt to EBITDAR (at acquisition): | 5.6x FY15 pro forma EBITDA |

| Operating Advisors: | Terry Leahy, Dick Olver |

| Status: | Pending – expected to close in Q3 2015 |

| Website: | www.motorfuelgroup.com |