-

Healogics is the largest outsourced wound care management services provider in the U.S.

Healogics is the largest outsourced wound care management services provider in the U.S.

Hospital outsourcing trends and industry insights that were significantly enhanced through Fund VIII’s ownership of Envision Healthcare led Fund IX to an agreement to acquire Healogics, the largest hospital outsourced wound care services provider in the United States

Healogics is the largest outsourced wound care services provider in the U.S. The company provides comprehensive wound care solutions, operating through a partnership model with hospitals to develop and manage outpatient wound care clinics. With an aging U.S. population, the prevalence of chronic illness is increasing, and in turn, driving growing demand for specialized wound care management. Chronic wounds cost the U.S. healthcare

system an estimated $55bn annually, and left unhealed, chronic wounds can lead to unnecessary complications such as increased hospitalization, readmissions, and prolonged length of stay, all of which will be increasingly penalized under the Affordable Care Act (ACA).

The Healogics transaction represents the continuation of CD&R’s strategy of investing in market-leading healthcare services businesses that improve the quality and lower the cost of care, have limited exposure to reimbursement risk, and operate business models characterized by low fixed costs and diversified revenue streams. In March 2015, Healogics completed the strategic acquisition of Accelecare, the second largest provider of outpatient wound care services with 138 centers under management and 90

Key Achievements

- Completed strategic acquisition of Accelecare

- Opened 48 new centers and signed 64 new clinic contracts in 2014

- Implementing new sales initiative targeting hospital system sales

- Dramatically ramped Healogics Specialty Physicians (“HSPs”) initiative, finishing 2014 with 60 employed physicians

employed physicians, further cementing the Company as the leading national provider of outsourced wound care services.

Company Profile

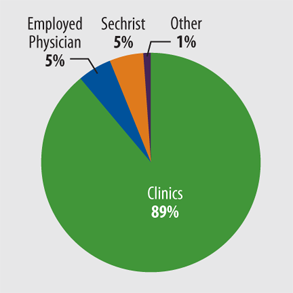

Headquartered in Jacksonville, Florida, Healogics is the largest outsourced wound care management services provider in the U.S. Pro forma for the acquisition of Accelecare, the company is over 7x larger than its next closest competitor, manages approximately 773 hospital outpatient Wound Care Centers (“WCCs”) and treated over 250,000 patients in 2014. Healogics’ nationwide network of WCCs represents an estimated 42% of all outpatient WCCs in the U.S. and an approximate 72% share of the outsourced wound care center market. In addition, the Company is vertically integrated through its ownership of Sechrist Industries, the leading global manufacturer of hyperbaric oxygen therapy chambers (“HBOTCs”), a critical piece of equipment used in the treatment of certain high-acuity wound care patients.

Healogics provides comprehensive wound care solutions, operating through a partnership model with hospitals to develop and manage outpatient wound care clinics. The company’s value proposition offers patients, payors and providers superior clinical outcomes and improved patient satisfaction while containing costs associated with improper or disorganized care. Healogics has 15+ years of wound care experience backed by a clinical database of over two million patient encounters that has driven a 91% patient heal rate, 94% patient satisfaction and an amputation rate of less than 1.5%. In addition to providing hospitals with enhanced clinical practice protocols, Healogics provides clinical oversight of the wound care facility led by a Healogics Program Director who manages the medical and administrative staff as well as leads patient acquisition and community education efforts.

2014 PF Revenue

2014 PF Revenue

Transaction Background

In July 2014, CD&R acquired Healogics for $910 million, excluding transaction fees and expenses. Fund IX invested approximately $314 million for an initial 95% ownership interest (remainder held by management and board members).

The Healogics transaction represents the continuation of CD&R’s strategy of investing in market-leading healthcare services businesses, including VWR, AssuraMed, Envision Healthcare and PharMEDium, that improve the quality and lower the cost of care, have limited exposure to reim-bursement risk, operate business models characterized by low fixed costs and diversified revenue streams and are competitively well positioned for continued growth.

Value Building Initiatives

- Accelecare Acquisition Integration / Synergies. Execute on business reorganization and cost reduction work streams required to realize synergies. Closely manage existing hospital customer relationships during transition and focus on contract retention activities. Avoid disruption / continue growth in base Healogics and Accelecare businesses (e.g. same-center volume growth initiatives, de novo clinic pipeline conversion, etc.)

- Employed Physician Initiative (HSP and AWP). Continue to expand employed physician model, which is designed to eliminate physician staffing burden on the hospital, enhance profitability, improve clinical outcomes and increase customer stickiness / switching costs. Leverage strengths of Healogics Specialty Physicians (HSP) in outpatient clinics and Accelecare Wound Physicians (AWP) in SNFs to create integrated wound care physician solution for hospitals and health systems.

773 pro forma clinics, including signed but not opened- Hospital System Penetration / Joint Ventures. More coordinated sales efforts to drive strategic partnerships with large hospital systems. Working on structure and economics to pilot JV model with several health systems. Continued penetration of multi-site initiative to add 2nd clinic within 35 mile radius of existing hospital.

- Care Coordination Across Settings. Leverage Healogics’ physician network to provide wound care services outside the hospital setting (e.g. skilled nursing facilities (“SNFs”), LTC, dialysis centers, etc.), capturing untapped professional fees and expanding value proposition. Opportunity to enhance coordination / referrals for patients requiring wound care services following discharge from hospital inpatient setting.

- Leverage Proprietary Technology Investments. Deployment of proprietary systems and technologies enhances Healogics’ value proposition, increases customer switching costs and often serves as a catalyst for contract term extensions. Proprietary CRM system provides focused targeting of addressable patient populations, driving increased clinic volumes. Electronic Medical Record (“EMR”) platform delivers data to hospital partners that is used to coordinate patient referral development and manage financial and operational metrics.

Looking Forward

The outlook for the business remains positive with a number of growth drivers gaining momentum: CRM and other patient referral initiatives driving accelerated same-center volume growth; new contract wins ahead of historical pace with significant runway remaining; contract retention ahead of plan and historical rates; integration of Accelecare business accelerating deployment of Healogics employed-physician initiative, particularly in SNFs; best practice sharing between Healogics and Accelecare organizations.

Investment Characteristics

Investment Period: July 2014 - Current Industry: Outsourced wound care management services Seller: Metalmark Capital Purchase Price: $910M, excluding transaction fees and expenses Purchase Multiple: 9.9x 2014 Run-Rate EBITDA CD&R Equity Investment: $314M (Fund IX) CD&R Equity Ownership (at acquisition): 95% Net Debt to EBITDA (at acquisition): 6.9x LTM 6/30/14 Financing EBITDA Operating Advisor: John Dineen Status: Private Unrealized Website: www.healogics.com

* Including estimated fees and expenses and the net present value of tax assets.

Summary Financials

LTM at Acq. (millions) FY2014 30-Jun-14