-

Fully Realized: 1.4x

HD Supply’s industrial distribution network operates over 650 locations across the United States and Canada, providing approximately one million SKUs to approximately 500,000 professional customers.

HD Supply’s industrial distribution network operates over 650 locations across the United States and Canada, providing approximately one million SKUs to approximately 500,000 professional customers.

With strong support from CD&R, HD Supply successfully navigated an unprecedented downturn in the construction industry and positioned itself for continued margin expansion, as well as organic and acquisition-related growth as end markets recover.

While the Great Recession interrupted CD&R’s original value-building plans for HD Supply, with ample financial flexibility and the relentless pursuit of operational improvements, the Firm bought time to enhance the company’s competitive standing and fully realized its investment through a successful public market exit that culminated in late 2014.

Key Achievements

-

Rationalized cost structure

- Closed lower performing locations

- Reduced headcount from 26,000 to ~15,500

- Tight SG&A controls

-

Restructured the product portfolio

- Divested non-core businesses

- Refocused the business on three core end markets (facilities maintenance, construction, infrastructure/energy)

-

Selectively invested in future growth

- Accretive acquisitions in core end markets

- Disciplined product pricing

- Lower cost country sourcing

- Private label penetration

-

Aggressively managed the balance sheet

- Refinanced all $6B of debt

- Pushed out debt maturities to 2017-2020

- Managed with a cash flow and high liquidity focus during the downturn

-

Successful public market exit

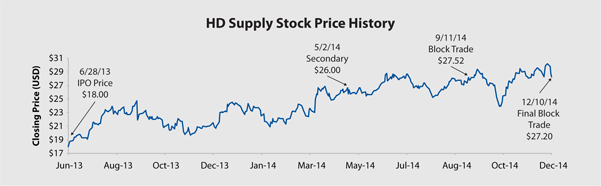

- Initial public offering (IPO) in July 2013

- Secondary offering in May 2014

- Final block trades in September and December 2014

-

Rationalized cost structure

-

Company Profile

HD Supply is one of the largest industrial distributors in North America, based on sales, serving the United States and Canadian maintenance, repair & operations, infrastructure & power and specialty construction markets.

The company operates approximately 650 locations across the United States and Canada, providing over one million SKUs to approximately 500,000 professional customers, including contractors, government entities, maintenance professionals, home builders, industrial businesses and government entities. For the twelve-month period ended November 2, 2014, net sales were approximately $8.8 billion.

Transaction Background

Leveraging CD&R’s prior successful investment experience with wholesale distribution, the Firm closely followed the individual businesses that ultimately became HD Supply well before they were brought together by The Home Depot from 2004 through 2006. In 2007, CD&R led the acquisition of HD Supply from The Home Depot in an $8.6 billion transaction in partnership with Bain Capital and The Carlyle Group.

The complex carve-out from The Home Depot was the product of an over three-year sourcing effort by CD&R. In aggregate, CD&R Fund VII and Fund VII (Co-Investment) and affiliates invested $725 million in equity in the initial transaction.

On the heels of rebounding financial performance and highly liquid debt capital markets, HD Supply completed

a series of transactions in 2012 and early 2013 which resulted in a broad balance sheet refinancing and extended the company’s nearest term debt maturities. As part of the 2012 refinancings, Fund VII and Fund VII (Co-Investment) invested $241 million, on a pro rata basis with the other equity sponsors, in a tranche of new senior unsecured notes. In February 2013, those senior unsecured notes were redeemed, generating a fully realized gross MOI and gross IRR of 1.75x and 100%, respectively.

On July 2, 2013, HD Supply completed its initial public offering at $18.00 per share. Subsequently in May, September and December 2014, Fund VII, Fund VII (Co-Investment) and affiliates completed the sale of their remaining shares, generating aggregate net proceeds of $973 million, or 1.3x the original cost basis in the HD Supply equity investment.

Together with the fully realized HD Supply debt investment, the aggregate HD Supply investment generated a 1.4x MOI.

-

Investment Thesis

D&R’s investment thesis was clear: operational improvements and greater concentration of resources on organic growth and market share gains through expansion into adjacent segments, new product introductions, increasing share of customer wallet and sales force initiatives, as well as accretive opportunistic acquisitions could be combined to drive top-line growth and increase profitability.

Value Building Strategy

While CD&R’s original thesis remained intact throughout the life of the investment, the severe downturn in the North American construction industry led to dramatic declines in the company’s sales and profitability from the time of the original investment through 2009. The Firm’s response to the sharp downturn was to pull harder and faster on the levers of operational transformation. HD Supply exited

non-core businesses where the company did not have market leadership and streamlined the organization into four core business lines. In addition, cost cutting and cash management efforts were accelerated though the company continued to make strategic investments that set the stage for outsized growth as end markets recovered.

With the business environment for the company starting to improve beginning in 2011, the significant operating leverage in the business resulting from the cost and productivity actions taken during the downturn provided a strong foundation for profitable, above-market growth. Each of the core lines of business: Facilities Maintenance, Waterworks, Power Solutions and Construction & Industrial - White Cap, significantly outperformed its respective market, taking share from competitors weakened by the unprecedented downturn. Importantly, the 2012 refinancings gave the company even more time and flexibility to meet its growth targets and strengthen HD Supply’s competitive positioning as one of the most valuable construction and maintenance supply players in North America.

-

Public Market Success

HD Supply completed a $1.1 billion IPO at $18.00 per share in July of 2013, and the shares trade on the NASDAQ Global Select market under the symbol “HDS.” Through a series of subsequent transactions in May, September and December of 2014, Fund VII, Fund VII (Co-Investment) and affiliates generated aggregate net proceeds of $973 million, or 1.3x the original cost basis in the HD Supply equity investment.

iX

- Text, Key Achievements

- 2014 v7

- Image, Caption, Inline Chart

- 2014

- Investment Characteristics, Summary Financials

- Completed (data in "HD Supply Case Study - 2014 Annual Review Excel Back-up_v2.xlsx")

Investment Characteristics

| Investment Period: | August 2007 - December 2014 |

| Industry: | Industrial and construction distribution |

| Seller: | The Home Depot |

| Purchase Price: | $8.6B |

| Purchase Multiple: | 9.2x LTM Adjusted EBITDA of $944M |

| CD&R Equity Investment (2007): | $725M (Fund VII and VII Co-Investment) |

| CD&R Equity Ownership: | 25%; sponsors control 75% in aggregate; (at acquisition) |

| CD&R Debt Investment (2012): | $241M (Fund VII and VII Co-Investment) |

| Net Debt to EBITDA (at acquisition): | 6.4x |

| CD&R Operating Partner: | Jim Berges |

| Status: | Fully realized (debt and equity) |

| Website: | www.hdsupply.com |

Summary Financials

| 12 month ended | |||

| (millions) | At Acquisition | February 2, 2014 | November 2, 2014 |