-

JDL is the nation’s largest distributor of wholesale irrigation, landscape lighting, nursery, and turf and maintenance supplies sold primarily to professional landscape contractors for use in residential and commercial settings.

JDL is the nation’s largest distributor of wholesale irrigation, landscape lighting, nursery, and turf and maintenance supplies sold primarily to professional landscape contractors for use in residential and commercial settings.

Reinvigorating growth and profitability by applying CD&R’s distribution expertise to a market-leading landscape products distribution business carved out from Deere & Co.

Built through a series of acquisitions that were never fully integrated, John Deere Landscapes (“JDL”) gradually became a noncore subsidiary of Deere & Co. (“Deere”). In 2013, Deere elected to partner with CD&R as part of a broader strategy to refocus on its core business and transition JDL to new ownership. In a corporate carve-out similar to many of Fund VIII’s partnership-oriented investment

structures, CD&R acquired an initial 60% ownership interest in the business and allowed Deere to retain an initial 40% ownership interest. CD&R Fund VIII’s acquisition was structured as a preferred equity investment that shares many of the key attributes that characterize the Firm’s partnership-oriented/solution capital investments: senior equity in a low leverage capital structure, a dividend-paying security, operational improvement potential, and the ability to capture equity upside in the business through conversion rights into common equity.

-

Key Achievements

- Hired current CEO Doug Black in April 2014 from Oldcastle, and he has since reconstituted and high-graded the executive team

- Management team has launched several initiatives in 2014 focusing on pricing, mix management and SKU rationalization, procurement, regional and area organizational structure and sales force effectiveness

- Significant improvement in working capital management, which was historically under-managed

- Acquired 4 businesses in 2014 with total revenue of $41 million and EBITDA of $3.5 million. In February 2015, JDL acquired Shemin Nursery Supply, which has total revenue of $135 million and EBITDA of $8 million

Company Profile

JDL is the nation’s largest distributor of wholesale irrigation, landscape lighting, nursery, and turf and maintenance supplies sold primarily to professional landscape contractors for use in residential and commercial settings. With over $1 billion in annual sales, approximately 2,000 employees and over 400 branches in the U.S. and Canada, the company is the only scaled national distributor in the industry and is 4x the size of its next largest competitor.

The company’s fragmented customer base is primarily comprised of professional landscape contractors. JDL’s largest customer represents approximately 2.5% of sales and the top 10 customers represent only approximately 5.5%. With its market-leading competitive position, the company is the largest customer in its market segment

for most of its suppliers, which include fertilizer blenders, chemical companies, irrigation OEMs and nursery growers.

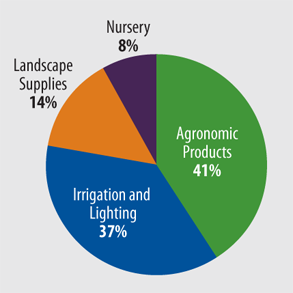

2014 Sales by Category

2014 Sales by Category

-

Transaction Overview

CD&R Fund VIII and affiliates invested $174 million in December 2013 for an initial 60% ownership stake in Deere & Co.’s landscape products distribution business, which continues to be called John Deere Landscapes. The transaction was valued at $463 million, including transaction fees and expenses, and Deere initially retained a 40% ownership interest in the company. CD&R had been actively monitoring the business since 2010 when Deere first contemplated the sale of the business. The firm’s industry and distribution expertise differentiated CD&R early on in the sale process. Deere then asked CD&R to present its operational approach and plans for the business to Deere and JDL senior management, after which Deere chose to work exclusively with CD&R to consummate a transaction. CD&R Operating Partner Paul Pressler became Chairman of JDL upon closing.

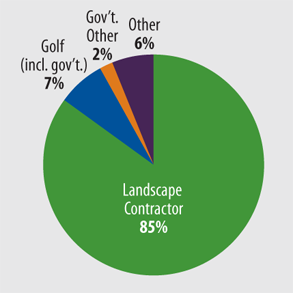

2014 Sales by Customer Type

2014 Sales by Customer Type

CD&R Fund VIII’s investment is in the form of a convertible preferred security with a 12% annual dividend rate, payable in-kind for two years and then in cash or in-kind at the company’s option thereafter. The preferred security is initially convertible into 60% of the outstanding common shares, with that ownership interest increasing over time to the extent dividends are paid in-kind.

Value Building Initiatives

The JDL management team has identified several initiatives to improve top-line growth, profitability and efficiency:

- Product Line Integration and Mix Management. Significant opportunity to further penetrate LESCO’s agronomic products in legacy irrigation branches and vice versa as well as drive more consistent penetration of Landscape Supplies and reduce SKU proliferation.

-

- Supplier Management. Significant opportunity to leverage JDL’s scale and national footprint to drive procurement efficiencies, particularly following transition away from legacy sole-source maintenance supply arrangement.

- Price Optimization. Opportunity for management and compliance of local branch price protocols.

- Organizational Structure / Sales Force Effectiveness. Analyzing local go-to-market strategies and implementing more customized region / area / branch structures as well as implementing a more performance-oriented incentive system.

- Industry Consolidation. Fragmented industry primarily comprised of family-owned businesses, and historically there has been no natural consolidator. JDL acquired 4 businesses in 2014 with total revenue of $41 million and EBITDA of $3.5 million. In February 2015, JDL acquired Shemin Nursery Supply, which has total revenue of $135 million and EBITDA of $8 million.

- Net Working Capital. In FY2014, despite 10.7% revenue growth, net working capital was a $9 million source of cash. Continued opportunity to lower overall working capital needs and better match seasonality of business.

Looking Forward

Under the new leadership of Doug Black, JDL’s management team is focused on leveraging its scale and national footprint to better serve its customer base, driving value through the key operating initiatives outlined above, selectively growing through strategic and synergistic acquisitions, and growing share in a marketplace that is expected to continue to benefit from positive residential and nonresidential construction tailwinds.

Investment Characteristics

| Investment Period: | December 2013 - current |

| Industry: | Landscape products distribution |

| Seller: | Deere & Company |

| Purchase Price: | $463M |

| Purchase Multiple: | 8.6x FY 2013 (Oct) Adjusted EBITDA of $54M |

| CD&R Equity Investment: | $174M (Fund VIII) |

| CD&R Equity Ownership: | 60% (at acquisition) |

| Net Debt to EBITDA (at acquisition): | 3.2x FY 2013 (Oct) Adjusted EBITDA |

| CD&R Operating Partner: | Paul Pressler |

| Status: | Private Unrealized |

| Website: | www.johndeerelandscapes.com |

Summary Financials

| 12 months ended December | ||

| (millions) | 2013 (At Acq.) | 2014 |