-

Overview

Clayton, Dubilier & Rice is one of the world’s most distinctive private equity firms. Since 1978, the Firm’s investment approach has blended investment judgment with world-class operating capabilities to create valuable businesses that generate attractive returns for our investors, which include some of the world’s most respected endowments, foundations, family offices and public and private pension funds.

CD&R’s resources are devoted to delivering consistent and superior risk-adjusted returns by identifying exceptional investment opportunities, frequently on an exclusive basis, exercising disciplined investment judgment, and post-acquisition building stronger businesses. The integration of CD&R’s investment and operating skills is the foundation of the Firm’s differentiated value creation model.

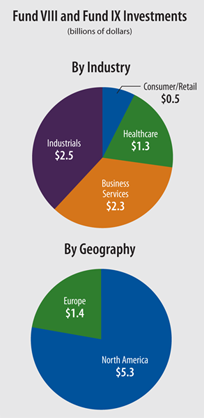

The company pursues investments in four verticals: Consumer/Retail; Healthcare; Industrials; and Services. Geographically, the Firm invests in North America and Europe.

CD&R has consistently identified and completed transactions, improved portfolio company performance and monetized investments across economic cycles. During the five years ending March 31, 2015, CD&R:

- Acquired 17 companies, many sourced on an exclusive basis, and invested aggregate fund capital of $5.9 billion;

- Guided its portfolio of market-leading companies to meaningful outperformance by leveraging their scale, pricing power and competitive strengths, while displacing or acquiring weaker competitors;

- Generated approximately $14.5 billion of proceeds.

-

The Firm’s sourcing and investment capabilities are geared to invest in market-leading consumer, healthcare, industrial and service businesses. As a result of this focused approach, CD&R is able to dig deeper to identify, on a very granular level, a set of tangible, quantifiable growth and profitability improvement initiatives that others may not see or appropriately value. CD&R’s highly disciplined investment sourcing emphasizes businesses which: (i) are fundamentally well positioned and operate in relatively benign industries; (ii) have broad spread-of-risk characteristics; and (iii) have the potential for dramatically improved performance.

Focused sourcing efforts, concentrated where CD&R believes it has a competitive edge. The Firm is a leading practitioner of partnership transactions in which the seller retains a minority stake in the divested business. We believe the Firm is competitively well positioned to capture transactions that fit this profile as a result of its direct access to management teams and corporate boards, reputation for operational excellence, and record of

developing innovative transaction structures tailored to address the strategic needs of the seller, whether corporate, a family owner or public shareholders. This source of deal flow has generated a number of exclusive transactions.

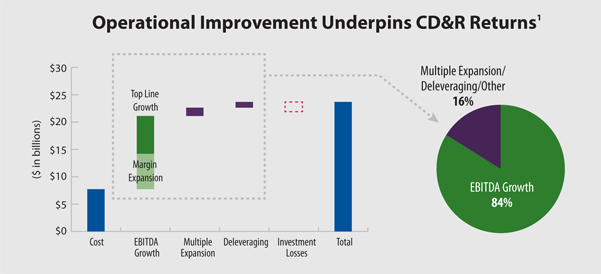

Operational improvement is the primary source of CD&R’s value creation. Approximately eighty-four percent of the Firm’s historical returns have been the result of EBITDA growth1. CD&R believes returns derived from building operationally-stronger businesses are repeatable and

-

more sustainable through a range of economic and financial environments. Importantly, CD&R’s portfolio has proven its durability during periods of economic volatility, as evidenced by the outperformance of Fund VII and Fund VIII businesses against comparable companies between 2008 and 20142.

Rigorous internal processes form the backbone of the Firm’s investment decisions and portfolio monitoring activities. CD&R believes that rigorous processes, in addition to deep experience and investment judgment, lead to better decisions. The Firm’s internal management practices, rigorous investment review processes and portfolio company oversight are designed to constantly improve decision making and ensure the highest standards of execution. These internal processes harness the knowledge and experience of the entire Firm and include:

(i) an Investment Committee that screens and vigorously tests new investment cases; (ii) weekly investment pipeline meetings; (iii) comprehensive weekly and quarterly Firm-wide portfolio reviews of each company’s progress; (iv)monthly operating reviews conducted by each deal team; (v) Portfolio Company Operating Reviews targeted at helping management teams work through important strategic decisions, talent management and execution issues; (vi) bi-annual Projected Returns meetings to support exit strategies and planning; and (vii) regular forums to promote best practice sharing across the portfolio.

The Firm’s differentiated investment strategy is supported by a similarly distinctive and stable organizational architecture. CD&R’s strategy is anchored in the belief that a highly cohesive firm, led by entrepreneurial, analytic people with shared values, makes better private equity investment decisions than diversified alternative asset management platforms. CD&R’s 53 professionals work from offices in New York and London. The highly cohesive and experienced partnership comprises 23 Financial and Operating Partners. The remaining professionals make up the Firm’s well-established second and third generation leadership tiers and reflect CD&R’s success in the past

decade developing a strong talent base through internal promotion. In addition, an experienced group of talented Advisors to CD&R funds assist in sourcing investment opportunities and improving portfolio company performance.

The Firm’s internal management practices, rigorous investment review processes and portfolio company oversight are designed to constantly improve decision making and ensure the highest standards of execution.

The Firm’s craft-based approach to private equity relies on a committed and cohesive investment team with a strong sense of shared purpose and values. The Firm’s professional team reflects a combination of experienced investors and operating executives. CD&R’s Financial Partners, largely promoted from within, have an average tenure at the Firm of 15 years. Members of the Firm’s Management Committee have an average tenure of 19 years. CD&R Operating Partners are

-

among the most recognized and successful corporate managers in the world and are highly integrated with the investment team. Their senior leadership roles at such marquee global enterprises as ABB, Allstate, BBA, Disney, Emerson Electric, GE, The Gap, Pepsico and Unilever, among others, provide the deep experience and credibility required to successfully work with portfolio company management teams to implement efficiency and growth strategies to enhance earnings. The Operating Partners comprise a seasoned group, with average experience of more than 35 years. The expertise of the Firm’s in-house Operating Partners is supplemented by a dedicated group of Advisors to the CD&R funds, including, among others: Jack Welch, former Chairman and Chief Executive Officer of General Electric, and Sir Terry Leahy, former Chief Executive Officer of Tesco plc. The industry and management expertise of the Firm permeates all aspects of CD&R’s investment activities. In addition to offering differentiated insights about potential transactions,

Operating Partners and Advisors have extensive business networks that provide personal access to corporate leaders and boards of directors globally. The close combination of investment judgment and operating expertise is the hallmark of CD&R’s model.