-

Fully Realized: 3.4x

Sally Beauty, an international specialty retailer and distributor of professional hair care and beauty supplies, generated 2012 revenues of $3.5 billion.

Sally Beauty, an international specialty retailer and distributor of professional hair care and beauty supplies, generated 2012 revenues of $3.5 billion.

Sophisticated retailing practices breathe new life and growth into an established retailer/distributor

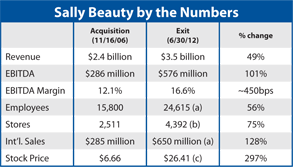

CD&R took a well-positioned corporate orphan, diversified its supplier base away from L’Oreal and invested heavily in top-line growth opportunities and margin improvement initiatives, which sacrificed short-term earnings but dramatically enhanced the longer-term growth trajectory of Sally Beauty. In the end, Sally grew revenues and EBITDA 49% and 101%, respectively, under CD&R Fund VII’s ownership, while margins expanded 450 basis points.

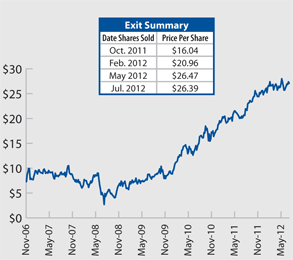

As the company’s reformulated growth trajectory took hold, the company’s share price

responded, increasing four-fold over the course of Fund VII’s ownership. Through a sequence of four public market sales and a share repurchase by the company, CD&R Fund VII fully exited its investment by July 2012 and generated total proceeds of $1.9 billion on its original $571 million investment, representing a gross MOI of 3.4x and a gross IRR of 25.4%.

-

Key Achievements

- Innovative structure facilitated a tax efficient carve-out from Sally Beauty’s former parent company, Alberto-Culver

- Expanded store base organically and through acquisitions in the U.S. and internationally

- Increased customer traffic through loyalty programs and customer relationship management

- Diversified Sally’s supplier base significantly and reduced historical dependence on L’Oreal

- Drove gross margin expansion through low cost country sourcing, increased mix of private label products and a continued mix shift to retail customers

Company Profile

Sally is an international specialty retailer and distributor of professional hair care and beauty supplies with 2012 annual revenues of approximately $3.5 billion. The business operates in two segments, which on a combined basis included an expansive network of approximately 4,500 stores:

- Sally Beauty Supply, a specialty retailer of open-line hair-care and beauty products; individual store locations offer between 6,000 and 9,000 products for hair, skin, and nails through leading third-party brands such as Clairol, Conair, and Revlon, as well as an extensive selection of proprietary merchandise.

- Beauty Systems Group, a full-service distributor of professional-only hair-care and beauty products targeted exclusively for salons and salon professionals.

Transaction Overview

In November 2006, CD&R Fund VII invested $571 million to acquire approximately 47.5% of Sally at $6.66 per share. The transaction was, to our knowledge, the first-ever Morris Trust executed with a private equity firm. Fund VII was by far the largest shareholder of Sally post-closing and was represented on the company’s board of directors by three CD&R partners (including the chairman of the board).

CD&R’s Sourcing Advantage

The differentiated nature of CD&R’s franchise, as well as the Firm’s carefully cultivated relationships with CEOs and board members, frequently have led corporate sellers to target CD&R as a preferred buyer, particularly for large, complicated “carve outs” or divestitures of orphaned divisions, which was the case with Sally Beauty. Initial discussions with The Alberto-Culver Company (“ACV”) regarding the purchase of its

-

Sally unit began seven years prior to the transaction. In April 2006, following the termination of an agreement to merge Sally with Regis Corp, CD&R immediately commenced discussions with ACV’s board to implement an innovative structure to permit the tax-free Sally spin-off and thereby fulfill ACV’s strategic objectives.

CD&R Value Creation

The company’s strong performance during Fund VII’s ownership was underpinned by solid execution of key operational improvement initiatives, including:

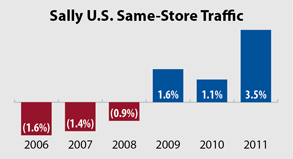

- Increasing customer traffic. The company invested in customer relationship management technologies and introduced a new “Beauty Club Card,” which helped drive more traffic and increase average ticket size. In addition, Sally targeted its marketing to retail and professional customers, introduced new product

categories such as skincare and nail-care, and optimized merchandizing through new product categories and innovative product packaging. The result was a 5%+ positive swing in year-over-year same store traffic growth, from a 1.6% decline in 2006 to a 3.5% increase in 2011.

- Gross margin expansion. Sally meaningfully improved gross margins under CD&R’s guidance. At the time of Fund VII’s acquisition, the company had no capability to directly source product in lower cost markets.

- Leveraging the experience and relationship network of CD&R Operating Partner Jim Berges, the company successfully transitioned significant amounts of its product sourcing to lower-cost countries. The gross margins on these directly sourced foreign products were 1,000 to 2,000 bps greater than products sourced through brokers and drove the company’s overall increase in margins, which were further enhanced by a shift toward higher-margin private label products and changes in retail/trade mix.

- New Domestic Stores. Building upon the experience CD&R gained from its Kinko’s investment in 1996, the Firm re-engineered the analytical and site selection process for new stores, which significantly increased Sally’s new store opening potential and provided the framework for organic store growth domestically in the U.S.

-

- Supplier base diversification. Shortly after CD&R Fund VII’s investment, L’Oreal informed Sally that it would no longer retain the rights to distribute L’Oreal’s professional products. Fortunately, CD&R had identified this risk during its due diligence and, under the leadership of Jim Berges, had a detailed action plan in place. Jim Berges and CEO Gary Winterhalter immediately began right-sizing the distribution infrastructure for the reduced sales volume, communicating retention bonuses for key salespeople and meeting with other key suppliers to secure new distribution rights. The preparation and execution of the CD&R-led action plan ultimately resulted in a business with higher profitability, greater sales efficiency and a more diversified supplier base.

- International growth. Through acquisitions and new store openings, Sally Beauty increased the number of international stores by 135%, from 289 to 679 under CD&R’s ownership.

- At the time of CD&R’s exit, international sales comprised approximately 20% of Sally’s total sales and represent a sustainable growth opportunity for the company going forward, particularly in Latin/South America and Western Europe, where attractive demographics, fragmented competition and strong secular trends are driving growth. Over the course of Fund VII’s investment, Sally invested in acquisitions totaling approximately $375 million in aggregate, including Salon Service (United Kingdom), Pro-Duo (Belgium, France and Spain), InterSalon (Chile), and Sinelco (Europe/North Africa), among others.

A Public Success

In October 2012, Private Equity International recognized CD&R with an award for Operational Excellence for its investment in Sally Beauty, which doubled EBITDA and increased margins 450 basis points under CD&R’s stewardship. The value creation strategy executed by CD&R and the company was validated through the

company’s strong financial results and consistent outperformance of the company’s share price, which grew four-fold during CD&R Fund VII’s ownership and enabled Fund VII to exit its position through a series of stock sales in 2011-2012.

Sally Beauty Share Price

Sally Beauty Share Price

Investment Characteristics

| Investment Period: | November 2006 - July 2012 |

| Industry: | Professional beauty products distribution |

| Seller: | Alberto-Culver Company |

| Purchase Price: | $3.1B |

| Purchase Multiple: | 10.4x |

| CD&R Equity Investment: | $571M (Fund VII) |

| CD&R Equity Ownership: | 48% (at acquisition) |

| Net Debt to EBITDA (at closing): | 6.3x |

| CD&R Operating Partner: | Jim Berges |

| Status: | Fully realized |

| Website: | www.sallybeauty.com |