-

B&M is the #2 discount retailer in the United Kingdom with sales of approximately £1.3 billion.

B&M is the #2 discount retailer in the United Kingdom with sales of approximately £1.3 billion.

Partnering with entrepreneurial family owners to take a fast-growing, market-leading discount chain in Europe to the next level of profitable growth by leveraging the unique insights and experience of Senior Advisor Sir Terry Leahy and CD&R Operating Partner Vindi Banga, two of the UK’s most highly regarded retailing and consumer executives

B&M is one of the leading general merchandise discounters in the UK and serves a market and a consumer demographic that has grown rapidly with significant scope for future expansion. Under CD&R ownership, the company has seen its revenues increase from £993 million in fiscal 2013 to approximately £1.6 billion in fiscal 2015, while EBITDA grew 66%.

CD&R Fund VIII acquired B&M in March 2013. Since acquisition, CD&R and B&M’s management team have focused their efforts on professionalizing the platform by introducing “best retail practices” in such disciplines as pricing, sourcing, private labeling, merchandising, marketing, distribution, logistics, in-store operations, and HR and talent management, among other areas.

In April 2014, B&M acquired a majority stake in Jawoll, the second largest out-of-town nonfood discounter in Germany. This acquisition was a landmark transaction in the history of B&M and started its international development.

-

In June 2014, B&M was successfully listed on the London Stock Exchange with a market capitalization of £2.7 billion. Through the IPO and a block trade in February 2015, CD&R Fund VIII has partially realized approximately 2.9x its original cost basis in this investment and continues to own approximately 10.1% of the company.

Company Profile

B&M is one of the leading general merchandise discount retailers in the UK with sales of approximately £1.6 billion and EBITDA of approximately £174 million in FY 2015. From its first store in Blackpool, Lancashire, B&M has grown to 425 stores with an average of 5,500 SKUs throughout England, Scotland, Wales and Northern Ireland.

The company employs more than 15,000 staff in the UK, sells branded grocery products and non-grocery products at very competitive prices and attracts more than 3 million customers to its stores weekly.

B&M’s profits are generated from a broad range of categories that all contribute positively and have proven relatively stable over time. In April 2014, B&M acquired a majority stake in Jawoll, the second largest out of town non-food discounter in Germany. Jawoll operates 50 stores and recorded FY 2015 sales of €121 million.

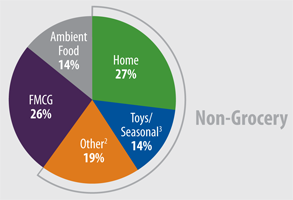

In the UK, the company operates successfully across a spectrum of store sizes from 6,000 sq.ft. to 35,000 sq.ft., in both town centre and out of town locations. About 60% of the company’s SKUs are non-grocery related with approximately 40% in grocery (almost entirely branded). The average basket size is approximately £10 and 66% of SKUs are above the £1 price point.

B&M has a track record of double digit revenue growth (including through the recent economic downturn) driven by strong store roll-out and solid like-for-like store performance

-

achieved on the back of an attractive and differentiated business model and a large market penetration opportunity. The company’s growth profile is reflected by sales and EBITDA CAGRs of approximately 29% and 37%, respectively, for the period March 2012 – March 2015. During the last five years, the company on average has added more than 50 stores per annum with positive like-for-like store growth.

Simon Arora (Chief Executive Officer), Bobby Arora (Trading Director) and other members of the family retained approximately 27% equity ownership interest in the business. Prior to B&M, they successfully built and sold Orient Sourcing Services, a homeware wholesaler for customers including Tesco, Argos and Bhs, to Lambert Howarth, which was one of Marks & Spencer’s biggest suppliers.

SKUs by Category

SKUs by Category

% Total Company SKUs 1CD&R Acts as the Catalyst for a Partnership Transaction

Similar to the Diversey, Sally Beauty and Brakes transactions, where CD&R partnered with large family ownership groups to provide capital and operational

guidance for the business, the Firm proactively approached the Arora brothers in early 2012 regarding a potential partnership transaction, where the family could monetize a portion of their equity stake and participate in the potential equity upside that they could continue to drive while leveraging CD&R’s operational capabilities. While a sale transaction was not something the Arora brothers previously had considered in the short-term, they spent the bulk of 2012 evaluating the merits of a partnership transaction and an outright sale of the business. Ultimately, they determined that their entrepreneurial passions were still embedded in the business, and they wanted to remain involved from an ownership and management perspective. A key to CD&R’s sourcing success was the Arora family’s focus on selecting a partner with specific expertise that could help elevate the financial performance and future development of the business. CD&R’s consumer retail success at Kinko’s and Sally Beauty, Sir Terry Leahy’s experience and proven track record at Tesco, and Vindi Banga’s consumer products expertise built during

-

30 years at Unilever were highly valued by the Arora family and served as critical catalysts for the transaction.

Value Building Initiatives

- Continue rapid expansion of store network in the UK to take advantage of sizeable market opportunity

- 42 net openings in FY 2014; 52 net openings in FY 2015

- Strong payback on new stores

- Continue to strengthen merchandising function

- Improve access to market-leading brands across grocery and non-grocery

- Continuous focus on refreshing best SKUs and categories

- Increase private label penetration, leveraging B&M’s sourcing skills

- Further investment in human resources to improve store efficiency and in-store service levels

- Improve effectiveness of recruitment process

- Roll-out training programs for in-store employees

- Integration of Jawoll acquisition

- Introduce B&M sourced products in the German market

- Deployment of a new ERP system

- Continue rapid expansion of store network in the UK to take advantage of sizeable market opportunity

Investment Characteristics

| Investment Period: | March 2013 - Current |

| Industry: | Discount Consumer Retail |

| Seller: | Arora Family |

| Purchase Price: | £975M |

| Purchase Multiple: | 9.4x EBITDA of £104M (8.5x run-rate EBITDA of £115m) |

| CD&R Equity Investment: | $301M (Fund VIII); $219M (LP Co-Investors) |

| CD&R Equity Ownership: | 60% (at acquisition) |

| Net Debt to EBITDA (at acquisition): | 4.0x PF EBITDA |

| CD&R Operating Partner: | Vindi Banga |

| CD&R Operating Advisor: | Sir Terry Leahy (Chairman) |

| Status: | Partially Realized |

| Website: | www.bmstores.co.uk |

Summary Financials

| Twelve months ended Mar. 31* | |||

| (millions of £) | 2014 | 2014 | 2015 |