-

SPIE serves more than 50,000 customers and is one of the largest multi-technical service providers in Europe.

SPIE serves more than 50,000 customers and is one of the largest multi-technical service providers in Europe.

Preemptively engaging with management prior to a formal sale process, CD&R Fund VIII acquired one of the leading multi-technical services businesses in Europe.

SPIE serves a broad range of end-markets and enjoys a resilient financial profile based on recurring “flow” business (est. 80% of sales). It serves more than 50,000 customers and is a leading European multi-technical service provider, with a particularly strong presence in France, Germany, the U.K. and the Benelux markets. With a base of recurring revenue from service contracts, the company’s business model has proved resilient through the economic cycle.

Prior to the launch of a formal transaction process, CD&R partnered with the management team to acquire the company and support the business in the next stage of its development. Post-closing, the company has performed in line with CD&R’s investment case and is executing well on market consolidation strategies and various margin improvement initiatives.

Company Profile

Spie is a European leader in multi-technical services and one of the few pure players in the sector with a true pan-European footprint. The company serves more than 50,000 customers, holding the #3 position in the French market and strong positions in the U.K., Germany and Benelux markets.

-

The company operates across 4 business units:

- France (46% of 2014 sales): multi-technical services and communications services for voice, data and information technology systems.

- Germany & Central Europe (15%): multi-technical services; activities centered on Germany and Switzerland. Business unit transformed following the platform acquisition of Hochtief Service Solutions in 2013.

- North-Western Europe (23%): multi-technical services; activities centered on the UK, the Netherlands and Belgium.

- Oil & Gas and Nuclear (16%): services to the upstream and downstream oil & gas industry; multi-technical services tailored to nuclear power plant maintenance, dismantling / decommissioning activities and fuel cycle processing (outside reactor zone).

FY 2014 pro forma revenue1 and EBITDA were €5,331 million and €371 million, respectively.

Proactive, Long-Term Sourcing Created a Preemptive Access

The SPIE investment represented the culmination of a five-year sourcing effort. Beginning with its carve-out from Amec plc in 2006, CD&R became increasingly familiar with SPIE and its management team, as CD&R’s Fund VI and VII portfolio company, Paris-based Rexel, served as one of SPIE’s largest suppliers. In early 2011 it became clear that PAI, the incumbent owner, was positioning to sell SPIE, at which time CD&R proactively engaged with SPIE management to preempt a formal sale process. By conducting extensive due diligence and formulating a business plan in conjunction with the management team, CD&R delivered a fully financed bid for the company with management support and ahead of a formal auction process.

Key Achievements

- Spie reported FY 2014 revenue of €5,220 million2, 14.5% above prior year, with resilient organic growth and continuous growth through bolt-on acquisitions.

- Pursued continuous EBITA margin improvement (+20 bps vs. 2013 pro forma), supporting strong cash flow generation and deleveraging.

- Successful integration of the largest-ever platform acquisition in Germany (Hochtief Service Solutions) – rapid realignment of German organisation, meaningful cost reductions implemented, exited or renegotiated loss-making contracts reviewed, significant contracts renewed and completion of 6 bolt-on acquisitions in 2014.

- In January 2015, Spie closed a refinancing that included a €431 million dividend payment to all shareholders (47% of capital returned in USD / 55% in EUR).

-

In August 2011, CD&R Fund VIII and CD&R-managed LP co-investment vehicles invested $715 million of equity, of which $399 million came from Fund VIII. As part of the transaction, CD&R significantly broadened the shareholder base among SPIE management and employees to more than 50% of staff, better incentivizing them to push the company to higher levels of performance.

Value-Building Initiatives

CD&R and the Spie management team have identified and executed several strategic and operating initiatives to drive growth, profitability and sustained cash generation:

- Continued focus on margin expansion and cash conversion in France: proactive management of cost base, tight bid and contract delivery, client and industry diversification; targeted focus on attractive

- end-markets and service offering, such as Information & Communications Technology Services (ICT);

- Integration of the HSS acquisition in Germany: strengthened SPIE’s market position in the highly fragmented and growing German market; synergies achieved by streamlining the business and cleaning up legacy contracts; achieved continuous EBITA margin increase throughout 2014; strong platform for bolt-on acquisitions;

- Transformation of the UK business model: roll-out of the SPIE model, focusing on smaller average contract size, increased number of clients and reducedcustomer reliance on main contractors, therefore de-risking the portfolio; achieved strong organic growth and margin improvement in 2014, underpinned by solid growth in key accounts (e.g. Rolls Royce) and strict financial and operational criteria; sustained growth from bolt-on acquisitions;

- Bolt-on acquisitions: continued investment in bolt-on acquisitions, therefore improving local density, driving service and geographic expansion; 38 bolt-ons acquired since 2011, with cumulative pro forma revenue of ~€780 million;

Looking Forward

In 2014, Spie has continued to drive value through bolt-on acquisitions, acquiring 6 businesses for ~€212 million of

-

revenues at ~6x EBITA (pre-synergies). The company has focused on strengthening the Hochtief Service Solutions platform acquired in 2013, completing several bolt-ons in Germany and Switzerland:

- Acquisition of FLEISCHHAUER in Germany, expanding in the highly attractive ICT market (annual sales of €45 million)

- Takeover of Johnson Controls Technischer Service employees in Germany (annual sales of €5 million)

- Acquisition of Connectis and Softix in Switzerland, strengthening the ICT service offering locally (annual sales of €117 million)

- Acquisition of Viscom System and Vista Concept in Switzerland, bringing complimentary skills and footprint (annual sales of €8 million)

In addition, Spie completed the acquisition of Scotshield Fire & Security in the UK, expanding its offering in the security market (annual sales of €26 million), and acquisition of Madaule in France (annual sales of €11 million).

Going forward, the company will continue to focus on leveraging its pan-European platform and drive additional value through organic growth and bolt-on acquisitions, as well as increase its multi-country services offering.

CD&R continues to work with management to evaluate the business and scale operational improvements across its many locations, as well as preparing SPIE’s potential capital markets exit. With an improved growth outlook in Europe, and a healthy acquisition pipeline, CD&R expects SPIE to continue to perform strongly.

Investment Characteristics

| Investment Period: | August 2011 - current |

| Industry: | Multi-technical, energy and communications services |

| Seller: | PAI Partners |

| Purchase Price: | €2.2B |

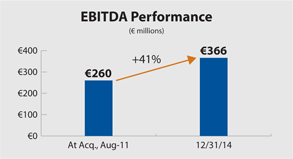

| Purchase Multiple: | 8.1x LTM Adjusted EBITDA of €268M* |

| CD&R Equity Investment: | $399M (Fund VII); $315M (LP co-invest) |

| CD&R Equity Ownership: | 59% (at acquisition), including co-invest |

| Net Debt to Financing EBITDA (at acquisition): | 5.1x |

| CD&R Operating Partner: | Roberto Quarta |

| Status: | Private unrealized |

| Website: | www.spie.com |

* Based on EBITDA performance for the full-year impact of acquisitions.

Summary Financials

| At Acquisition | FY ended Dec. 31, | ||

| (millions of euros) | Aug-11 | 2013 | 2014 |