-

Fully Realized: 2.6x

Hertz Rent-A-Car operates from approximately 10,300 owned and licensed locations in approximately 150 countries worldwide.

Hertz Rent-A-Car operates from approximately 10,300 owned and licensed locations in approximately 150 countries worldwide.

Premier global brands, market position, and investment drive growth; cost efficiencies enhance earnings and fund strategic initiatives; and strong cash flow utilized to deleverage

After carving Hertz out of the Ford Motor Company (“Ford”) in 2005, CD&R helped guide the improved operating profile of the business in terms of profitability, expanded service offerings and geographic reach, taken the business public and fully realized the Firm’s original and follow-on investments.

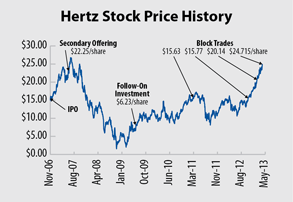

Through a series of dividends, a secondary offering and four block trades, CD&R Fund VII fully realized the Hertz investment, generating 2.6x capital invested and a 33% gross IRR.

Key Achievements

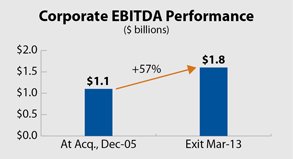

- Increased corporate EBITDA 57% since acquisition

- Generated $2.7 billion of cumulative cost-savings under CD&R ownership

- Established building blocks for global expansion

- Executed strategic growth initiatives, including acquisitions across all business lines and a greater focus on energy efficiency

- November 2012 acquisition of Dollar Thrifty significantly expanded value-oriented product offering

- Institutionalized efficiency processes

- Proactively managed the balance sheet to ensure flexibility

-

Company Profile

The Hertz Corporation is comprised of two primary businesses: Hertz Rent-A-Car (RAC) and Hertz Equipment Rental Corp. (HERC). Hertz has been in the car rental business since 1918. Combined with the Dollar and Thrifty brands, RAC operates from approximately 10,300 owned and licensed locations in approximately 150 countries worldwide. Hertz is recognized as the customer-service leader in the rental-car industry and has particularly strong positions in the high-margin corporate and leisure sectors, where service is most highly valued. Hertz has been in the equipment rental business since 1965. HERC is one of the largest equipment rental businesses in North America (based on revenues) and operates approximately 340 branches worldwide. Hertz has approximately 38,300 full-time employees worldwide and approximately $10 billion of annual revenue pro forma for the acquisition of Dollar Thrifty.

Long-Term Sourcing

CD&R first approached Ford about Hertz three years prior to Fund VII’s 2005 investment. Over that period, the Firm formed a differentiated view of what was possible in terms of financing the transaction and identified key areas of business performance improvement. The long-term sourcing effort ultimately positioned CD&R and its partners to successfully acquire the business. In December 2005, CD&R partnered with The Carlyle Group and Merrill Lynch Global Private Equity to acquire Hertz from Ford for $14.8 billion. At closing, CD&R Fund VII and CD&R-managed LP co-investment vehicles invested a total of $775 million in the transaction, including $497 million from Fund VII, for a 34% equity stake in the company. CD&R led the transaction, and former CD&R Operating Partner George Tamke helped lead the company’s operational transformation first from his role as Chairman, and now as Lead Director of the board. In July 2009, CD&R Fund VII invested an additional $197 million in Hertz shares at a price of $6.23 per share.

Value Building Strategy

The acquisition of Hertz represented a classic CD&R investment as a complex carve-out of an undermanaged, non-core subsidiary with market-leading positions and significant room for operational improvement. CD&R’s considerable

experience with complex, multi-location business models proved critical as Hertz aggressively leveraged its brand and market leadership positions. Under CD&R’s ownership,

-

EBITDA margins in the company’s RAC business expanded at almost twice the rate of its closest competitor, Avis-Budget Group.

Through a series of dividends, a secondary offering and four block sales, CD&R Fund VII’s investment generated total proceeds of $1.6 billion, representing a $1.0 billion gain for CD&R Fund VII, a gross of 2.6x capital invested and a gross IRR of 33%.

CD&R worked closely with Hertz management to drive a number of operating improvement and revenue growth opportunities, categorized into five broadly defined initiatives:

- Business productivity. Continued emphasis was placed on increasing employee and process productivity to improve throughput and enhance overall efficiency. The company delayered

- and consolidated regional management and drove efficiency through the integration of various back office and support operations.

- Customer service. Hertz focused on initiatives to drive customer service levels to all-time highs, implementing a series of service and technology offerings to widen the differentiation gap versus

- its competitors. The company’s worldwide RAC Net Promoter Score was up 6.4% in 2011.

- Fleet management improvements. Hertz improved utilization management by right-sizing the fleet to match demand trends and yield higher revenue and profitability per vehicle. The company diversified its fleet supplier base and utilized alternative fleet disposition channels, including direct-to-dealer sales and direct-to-consumer sales via the internet, to achieve higher resale values relative to traditional car auctions.

- Outsourcing and business process re-engineering. The company is standardizing work processes through the sharing of global best practices, with a focus on processes such as fleet management, vehicle preparation and cleaning, vehicle sales, logistics, transportation and maintenance. These efforts encompass the Hertz Improvement Process, an employee-driven program that utilizes Lean Six Sigma techniques to improve productivity.

-

- Strategic growth opportunities. Hertz completed the acquisition of Dollar Thrifty in November 2012, creating a global, multi-brand rental car leader that offers customers a full range of rental options through its strong premium and value brands. Integration is underway and is expected to yield at least $160 million of annual cost synergies. In 2011, the company acquired Donlen, giving Hertz an immediate leadership position in long-term vehicle and equipment leasing and fleet management services to corporate customers. Other strategic initiatives included: continuing off-airport expansion and penetration of the insurance replacement market; growing Hertz on Demand (formerly Connect by Hertz, a global car sharing service) through rebranding efforts and program enhancements; continuing to pursue new accounts across all businesses and internationally (such as new locations in China and Brazil);

- and broadening geographic reach and end-markets in equipment rental through acquisitions, including WGI Rentals (2011), Delta Rigging & Tools’ offshore division (2011), DW Pumps (2011), Cinelease (2012) and Arpielle (2012).

Investment Characteristics

| Investment Period: | December 2005 - May 2013 |

| Industry: | Car Rental/Equipment Rental |

| Seller: | Ford Motor Company |

| Purchase Price: | $14.8B |

| Purchase Multiple: | 6.2x |

| CD&R Equity Investment: | $621M Fund VII ($972M including LP Co-Investment) |

| CD&R Equity Ownership: | 34% (at acquisition); sponsor group 100% |

| Net Debt to EBITDA (at acquisition): | 4.7x |

| Former Operating Partner: | George Tamke |

| Status: | Fully Realized |

| Website: | www.hertz.com |