-

Strategy

CD&R believes a strategy based on combining skilled investment insight and judgment with world-class operating expertise represents the most effective basis for achieving consistently attractive risk-adjusted returns. CD&R’s investment focus, the composition of its professional base and the structure of its processes all reinforce this approach.

The Firm’s differentiated strategy is built around five pillars:

1. Tight integration of investment and operating skills at every stage in the investment process. The way in which the Firm merges these two skill sets throughout the investment process is what makes CD&R different and has produced a significant flow of attractive, often exclusive, investment opportunities not easily replicated in the public markets. These transactions involve a high degree of complexity, detailed and thorough due diligence, granular investment assessments and intensive post-acquisition

operational execution. CD&R believes its proven model of integrating financial and operating teams to identify investment opportunities fitting a well-defined profile, its differentiated relationship network and its expertise in consumer, healthcare, services and industrial businesses will continue to be a competitive sourcing advantage globally.

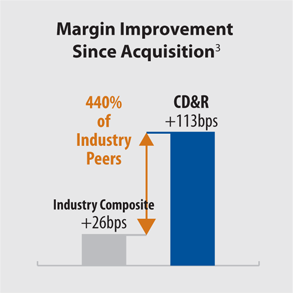

CD&R portfolio companies have expanded EBITDA margins at more than four times the rate of their industry peers.

2. Disciplined, consistent and clearly-defined transaction parameters ensure that the Firm’s targeted sourcing efforts are concentrated where it believes it has a clear competitive edge and can generate investments that are not replicable in the public markets. As a result, CD&R has been able to acquire assets at attractive multiples on both an absolute and relative basis. To ensure that the Firm avoids allocating resources to transactions outside of its

-

3. Active industrial approach to post-acquisition ownership. The Firm believes that it actively drives portfolio company outperformance through execution and operational improvement skills, as well as a deep understanding of markets and critical value-creation levers. CD&R’s active ownership model enhances the growth of portfolio businesses by providing strategic, financial and operational leadership, creating better governance structures, attracting talent, and streamlining decision-making. The joint effort of Financial and Operating Partners plays out in daily interactions with management teams, monthly operating reviews and Portfolio Company Operating Reviews. CD&R’s business-building expertise has produced strong outperformance. For Fund VII (2005), portfolio revenues rose 21% and EBITDA was up 58% (figures represent the equity-weighted average change from acquisition through December 31, 2014). Likewise, for Fund VIII (2009), portfolio revenues increased 22% and EBITDA 45%. While the results are strong on an absolute basis, they also compare favorably against the competition. A Duff & Phelps analysis shows that CD&R Fund VII and

Fund VIII portfolio companies expanded EBITDA margins at more than four times the rate of their industry peers3.

4. Careful crafting of capital structures. CD&R structures transactions to ensure portfolio company balance sheets

have ample flexibility to support business growth and transformation. CD&R has dedicated resources to coordinate all financings, and the Partner in charge of this effort, Michael Babiarz, has been with CD&R for more than 25 years. The Firm’s record of prudent debt financings is reflected in the resilience of the portfolio company capital structures put in place between 2005 and 2007. There have been no financial covenant breaches, no distressed equity infusions, and no forced restructurings in CD&R’s portfolio throughout or after the financial crisis. CD&R proactively managed the balance sheets and tapped the credit markets to refinance and maximize the companies’ financial flexibility and reduce financing costs.

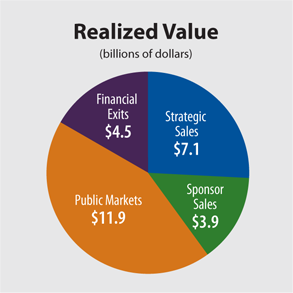

5. Maximizing exit optionality. The Firm believes that building better businesses invariably leads to multiple exit options, irrespective of capital market conditions. Throughout CD&R’s history, realizations have most often been accomplished through sale transactions. In many cases, the Firm’s portfolio companies have multiple attractive exit alternatives, including:

-

- Private sales. Sustainable improvements to portfolio company performance have led CD&R to a number of highly rewarding sales to strategic buyers, such as the sale of AssuraMed to Cardinal Health for 3.3x or Diversey to Sealed Air Corporation in a transaction that returned 2.4x invested capital and a gross IRR of 60%.

Exit Alternatives: