-

BCA is the market leader in used vehicle auctions and remarketing throughout the United Kingdom and continental Europe with 50 sites across 13 countries. A classic CD&R buyout that transformed the UK’s leading used vehicle auction provider into Europe’s leading multi-channel vehicle remarketing platform

BCA is the undisputed market-leading used vehicle marketplace in the United Kingdom, with penetration rates of over 40%. Under CD&R ownership, BCA diversified its business by adding a vehicle buying unit with the acquisition of WeBuyAnyCar.com (“WBAC”), expanding in continental Europe and Brazil, and launching a range of new value-added service offerings, as well as a buyer finance proposition. In addition, the company invested meaningfully in its technology and digital platforms to better serve its customers and

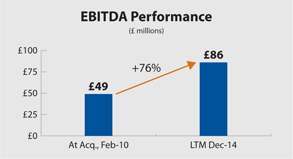

adapt to changing consumer behavior. The result was an increase in EBITDA of approximately 76% under CD&R’s ownership. With solid performance gains and a strong growth outlook, the company was acquired by a publicly listed investment vehicle, Haversham Holdings, in an April 2015 transaction valued at approximately £1.2 billion. The transaction generated proceeds of £537 million (approximately $800 million), including £512 in cash and £25 million in Haversham’s stock, to CD&R Fund VIII and affiliates. Including the $241 million dividend paid in April 2011, the total value of CD&R Fund VIII’s investment in BCA upon the closing of the sale to Haversham was approximately $1 billion, or 3.0x capital invested, and the investment generated a 33% gross IRR.

-

Key Achievements

- Transformed BCA from a physical auction business to a multi-channel marketplace by:

- Developing online capabilities

- Introducing further ancillary remarketing services and sophisticated pricing/valuation tools

- Acquiring WBAC

- Increased market share in the UK

- Increased market penetration in continental Europe

- Optimized pricing strategy

- Launched buyer finance business

- Strengthened the management team

- Exit at 3.0x MOI and 33% gross IRR

Company Profile

BCA is the market-leading used vehicle marketplace throughout the United Kingdom and continental Europe with 50 sites across 13 countries. The company provides physical and on-line auctions, multi-channel de-fleet solutions, and a variety of ancillary services like transport, vehicle inspection, valeting and financing. The company’s business model also exhibits a broad spread of risk. Europe’s leading automotive manufacturers, motor vehicle dealer groups and rental, fleet, leasing and finance companies choose BCA for vehicle remarketing to over 50,000 buyers, mostly used car dealers. BCA sells 1 million vehicles each year worth over £6 billion, and the company’s top 10 buyers represent less than 10% of total sales. WBAC is a clear leader in the fast growing UK guaranteed cash sale market and possesses a meaningful first mover advantage, strong brand recognition, a best-in-class pricing model and unmatched geographical coverage (over 200 sites in the UK).

CD&R Investment Overview

Building upon CD&R’s historical expertise in both business services and vehicle fleet management (e.g., Hertz), CD&R was well positioned to evaluate and move quickly in 2009

when BCA became available for sale. In a period of global credit markets dislocation, the Firm crafted a financing package that included a group of 8 lenders and a capital structure that was comprised of 60% equity at closing.

Over the course of CD&R Fund VIII’s first year of ownership, a combination of operating and financial performance improvement and more liquid financing markets created the opportunity to recapitalize the business in April 2011 and return approximately 70% of Fund VIII’s original investment. In August 2013, BCA acquired WBAC, the UK’s leading vehicle buying business.

- Transformed BCA from a physical auction business to a multi-channel marketplace by:

-

At the end of 2014, BCA was approached by a publicly listed investment vehicle, Haversham Holdings, which offered to purchase the business in a transaction valued at £1.2 billion. The transaction subsequently closed in April 2015 and generated proceeds of £537 million (approximately $800 million), including £512 in cash and £25 million in Haversham’s stock, to CD&R Fund VIII and affiliates. Including the $241 million dividend paid in April 2011, the total value of CD&R Fund VIII’s investment in BCA upon the closing of the sale to Haversham was approximately $1 billion, or 3.0x capital invested, and the investment generated a 33% gross IRR.

Value-Building Strategies

Management and CD&R identified and executed several strategic and operating initiatives during the course of Fund VIII’s ownership:

- UK volumes: volume growth through new data driven services (e.g. Market Price); new customer wins (e.g. Mercedes Benz Financial Services)

- Penetration in continental Europe and beyond: new sites opened in France, Netherlands and Italy; IMS capability to deepen vendor relationship strengthened with the acquisition of Hartmann; strengthened European management team to support growth; Fleet Select acquisition in the Netherlands; invested in Brazilian JV

- Pricing: optimized buyer pricing

- Penetration opportunity in ancillary services: launched BCA Assured; rolled out data driven pricing tool; built buyer finance business

- Operating improvement: strengthened IT capabilities to support transition from physical auction business to multi-channel marketplace

- WBAC acquisition: strengthened BCA’s position in the growing guaranteed cash sale segment of the market; strengthened BCA’s offer to dealers; strengthened BCA’s online and data capabilities, increased customer lock-in; Launched WBAC in the Netherlands

Investment Characteristics

| Investment Period: | February 2010 - April 2015 |

| Industry: | Professional used car remarketing |

| Seller: | Montagu Private Equity Limited |

| Purchase Price: | £418M |

| Purchase Multiple: | 8.3x LTM Adjusted EBITDA of £47.1M (excluding fees) |

| CD&R Equity Investment: | $352M (Fund VIII) |

| CD&R Equity Ownership (at acquisition): | 78% |

| Net Debt to EBITDA (at acquisition): | 3.3x LTM Adjusted EBITDA of £47.1M |

| CD&R Operating Partner: | Fred Kindle |

| Status: | Fully realized (3.0x Gross MOI)* |

| Website: | www.british-car-auctions.co.uk |

* CD&R Fund VIII and affiliates received approximately £25 million of Haversham stock as part of the consideration in the sale transaction. These Haversham shares remain unrealized.