-

Envision is a leading provider of physician-led, outsourced medical services in the United States with more than 20,000 affiliated clinicians.

Envision is a leading provider of physician-led, outsourced medical services in the United States with more than 20,000 affiliated clinicians.

Leading provider of physician-led, outsourced medical services, competing in large and highly fragmented markets with consistent underlying market volume trends; significant emphasis on driving accelerated revenue growth (both organic and acquisition) and realizing meaningful operational improvement potential

As healthcare reform in the United States unfolds, physicians have become the lynchpin in the management of costs and the delivery of quality healthcare. Medical care providers that can demonstrate differentiated operational value-add, better clinical outcomes and/or system efficiencies will likely experience outsized future growth. With CD&R Fund VIII’s 2011 acquisition of Envision Healthcare Corporation (formerly Emergency Medical

Services Corporation), CD&R believed it was well-positioned to capitalize on these trends and the strategic importance of physician services.

At the time of CD&R’s acquisition, Envision consisted of (i) a leading provider of facility-based outsourced physician services in EmCare and (ii) a leading provider and manager of community-based medical transportation services in American Medical Response (“AMR”). During CD&R Fund VIII’s ownership, the company delivered strong performance against key value creation initiatives, including robust new contract growth and expansion of the integrated services offering at EmCare, continued 911 emergency contract wins and execution on significant margin improvement initiatives at AMR, and the

-

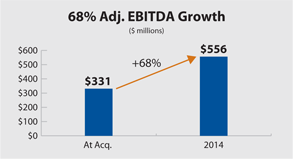

development of a physician-led, post-acute comprehensive care management platform, Evolution Health. During Fund VIII’s’ ownership, Envision’s revenue and EBITDA increased 50% and 68%, respectively.

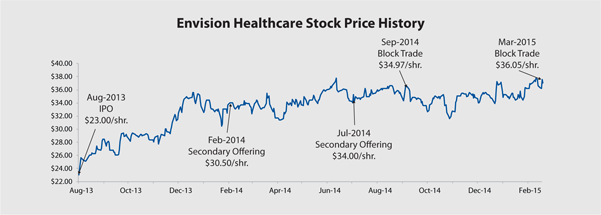

On the heels of the Company’s strong competitive positioning, robust growth profile and consistent track record of execution, Envision successfully Completed an IPO in 2013 and a series of subsequent secondary offerings and block trades that allowed Fund VIII to fully realize its investment by March 2015, generating a 5.3x MOI and 74% gross IRR.

Company Profile

Envision is a leading player in two large and highly fragmented healthcare services markets in the United States through its EmCare and AMR operating segments, both of which benefit from consistent underlying market volume trends driven by an aging population and the continued trend toward outsourcing of health services by hospitals. Envision’s third segment, Evolution Health, was launched in 2012.

- EmCare is a leading provider of integrated physician services to healthcare facilities. With more than 40 years of operating history and employing over 14,000 physicians and other clinicians, EmCare provides services to approximately 780 clinical departments, with EmCare physicians managing and improving the performance of their customer’s emergency department, hospitalist/inpatient care, anesthesiology, radiology/tele-radiology and surgery programs.

- AMR is a leading provider and manager of medical transportation services to communities, government agencies, healthcare facilities and insurers. With more than 55 years of operating history and employing over 14,000 paramedics, EMTs and nurses, AMR has more than 3,800 contracts to provide emergency transport, non-emergent transport, managed transportation, fixed-wing air ambulance, offshore/disaster preparedness and mobile healthcare services.

-

- Evolution Health is a provider of physician-led post-discharge transitional care services to patients in their homes utilizing a network of medical providers, with a mobile physician at the core of the service offering. The services of Evolution Health are designed to improve the quality of care and reduce cost for the most medically fragile patients in the United States.

Transaction Overview

CD&R secured the Envision investment after a 5-year sourcing effort in which CD&R closely tracked the company’s performance while analyzing comparable businesses across the healthcare services sector. Once the business was for sale, CD&R leveraged the deep domain expertise and unique insight into the changing healthcare landscape of Operating Advisor and former Aetna, Inc. Chief Executive Officer, Ron Williams, as well as CD&R’s previous success executing operational transformations in multi-location businesses similar to AMR in order to position the Firm to be the winning bidder. In May 2011, CD&R Fund VIII acquired Envision in a public-to-private transaction valued at $3.2 billion. CD&R Fund VIII invested $450 million, and a CD&R-managed LP co-investment vehicle invested $435 million.

As a result of the company’s strong earnings growth, robust free cash flow generation and debt reduction, as well as attractive financing markets, Envision Completed a $450 million dividend recapitalization in October 2012, which returned approximately 46% of Fund VIII’s original equity invested.

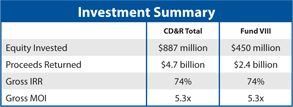

In August 2013, Envision successfully Completed an initial public offering at $23 per share. Thereafter, CD&R executed two secondary offerings (February 2014 and July 2014) and two block trades (September 2014 and March 2015), which taken together with the October 2012 dividend, generated $4.7 billion of net proceeds, including $2.4 billion to CD&R Fund VIII and $2.3 billion to CD&R-managed co-investment vehicles. In aggregate, the Envision Healthcare investment generated a 5.3x MOI and 74% gross IRR.

-

Value Creation Strategies

Throughout the tenure of CD&R’s ownership, the company executed several strategic and operational initiatives, which in turn, accelerated Envision’s growth trajectory and profitability and formed the foundation for Fund VIII’s successful realization of its investment.

- New Contract Growth

- EmCare

- Achieved share gain from regional and local competitors driven by EmCare’s proven operational differentiation

- EmCare

-

- EmCare (cont.)

- Benefitted from significant acceleration in hospital outsourcing due to continued cost pressures and inability to match EmCare’s operational metrics

- AMR

- Contract growth driven by improvement in competitive landscape (key distressed competitors) and benefits from AMR’s proprietary clinical database, which provides analytical support to claim of better outcomes

- EmCare (cont.)

- EmCare Integrated Service Offering

- Cross-sold full bundle of EmCare services in order to fully monetize the entire EmCare service offering within a single hospital location

- Leveraged integrated service offering to enter into several transformational joint-venture (JV) relationships with a number of leading hospital systems

- New Contract Growth

-

- AMR Margin Improvement

- Improved margins via contract rationalization, organizational restructuring, field operations optimization, support function efficiencies, infrastructure consolidation and technology efficiencies

- AMR EBITDA margin improved 313 bps from CD&R’s acquisition to December 31, 2014

- Continuum of Care Platform Expansion

- During CD&R’s ownership, Envision added its Evolution Health platform, which provides physician-led, post-discharge transitional care services into the “medical home” for chronic disease patients

- Evolution Health provides Envision the ability to service patients across the entire continuum of care, from pre-hospital and inter-facility with AMR, to the full suite of hospital-based services at EmCare, to the post-acute setting with Evolution

- Selected Acquisitions

- The highly fragmented markets that Envision operates in provided ample supply of tuck-in opportunities which CD&R took advantage of during its investment horizon

- AMR Margin Improvement

iX

- Text

- 2014 v6

- Image, Caption

- 2014

- Investment Characteristics

- use same table as last year, but status should read Fully Realized: DONE

- Investment Characteristics, Summary, Ownership, Capitalization, Maturity Schedule

- Completed (data in "Envision Healthcare Case Study - 2014 Annual Review v6.docx")

- Leadership

- No new content received

- Line Graph, Investment Summary, EBITDA Growth

- migrated from PDF

Investment Characteristics

| Investment Period: | May 2011 - Current |

| Industry: | Healthcare Services |

| Seller: | Public Shareholders |

| Purchase Price: | $3.2B |

| Purchase Multiple: | 9.6x LTM Adjusted EBITDA of $331M |

| CD&R Equity Investment: | $450M (Fund VII); $435M (LP Co-Investors) |

| CD&R-Affiliated Equity Ownership: | 88% (at acquisition) |

| Net Debt to Adjusted EBITDA (at acquisition): | 6.9x |

| Operating Advisor: | Ron Williams |

| Status: | Fully Realized |

| Website: | www.envisionhealthcare.net |

Summary Financials

| Twelve months ended December 31, | ||||||

| (millions; FY Dec) | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |