-

Fully Realized: 2.4x

Diversey is a leading global provider of commercial cleaning, sanitation and hygiene solutions.

Diversey is a leading global provider of commercial cleaning, sanitation and hygiene solutions.

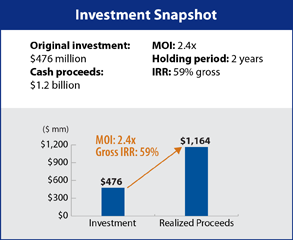

Refocusing a business model, increasing productivity and profitability and capitalizing on a strong emerging markets presence led Sealed Air Corporation to acquire Diversey from CD&R Fund VIII in a transaction that generated a 59% gross IRR and 2.4x multiple of investment

In a strategic partnership with the S. C. Johnson family, CD&R invested $476 million for a 45.9% equity interest in Diversey Holdings, Inc. When Fund VIII made the investment in November 2009, Diversey was winding down a multi-year restructuring plan, but its EBITDA margins still lagged those of its primary competitor, signaling the potential for additional profitability enhancement.

Company Profile

Diversey is a leading global provider of commercial cleaning, sanitation and hygiene solutions with over $3 billion in sales. The company has a highly diversified geographic and industry presence serving customers in over 175 countries across a broad spectrum of end markets. One of only two global players in the over $40 billion industrial and institutional cleaning and sanitation marketplace, the company offers a broad portfolio of largely consumable products and ongoing services that create recurring revenue through repeat purchase behavior. Diversey delivers value to its customers by designing solutions that lead to demonstrable reductions in waste, water and labor use and therefore both support sustainability and deliver compelling cost savings to customers.

-

Transaction Background

CD&R Fund VIII’s investment in Diversey was the culmination of a multi-year sourcing process. The Firm

initiated discussions with the company (then named Johnson-Diversey, Inc.) in 2006 and maintained a dialogue with key management and shareholders (primarily the S.C. Johnson family and Unilever plc), which ultimately positioned CD&R to work alongside the shareholder group in developing a holistic solution to a corporate obligation to repurchase Unilever’s equity interest. As a result, in early 2009, the Johnson family selected CD&R as its exclusive partner in the recapitalization of the company on the basis of the Firm’s unique combination of experience investing in distribution and services businesses, operating expertise, and history of executing complex corporate transformations. CD&R provided the new equity capital necessary to support a full refinancing and repurchase of the vast majority of Unilever’s equity stake. The Johnson family retained a 50% share in the company, and Unilever retained a residual 4% ownership interest in the recapitalized company, renamed Diversey.

Value Creation Strategy

At different points in time over the course of the investment, CD&R Operating Partners Vindi Banga and Jim Berges served as chairman of Diversey’s executive committee, and together with the entire CD&R deal team, worked closely with management to improve the performance of the business. This was achieved through a combination of operational initiatives including:

- Pricing and mix management. Invested in systems to capture global customer and product data and more effectively manage profitability across products and markets, as well as more effectively manage pricing and customer and product mix across the organization.

- Value chain efficiencies. Reduced supply chain costs through portfolio optimization and SKU reduction, centralized procurement and strategically utilized contract manufacturing.

-

- Cash management. Tightened controls and revised incentives around working capital management to improve cash flow.

- Organizational re-design. Transitioned the company from a regional structure to a global, sector-led structure in order to better support a solutions-based value proposition and reduce operational complexity.

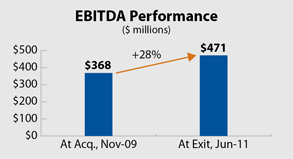

The result was a 28% increase in LTM EBITDA from acquisition to June 30, 2011 and 275 bps of margin expansion over the same period, which was more than 3x the margin improvement that Diversey’s nearest competitor, Ecolab, experienced over the same time period.

Investment Characteristics

| Investment Period: | November 2009 - October 2011 |

| Industry: | Commercial cleaning and hygiene products |

| Seller: | Unilever and the S.C. Johnson Family |

| Purchase Price: | $2.8B |

| Purchase Multiple: | 7.5x LTM Adjusted EBITDA of $368M |

| CD&R Equity Investment: | $476M (Fund VIII) |

| CD&R Equity Ownership: | 46% (at acquisition) |

| Net Debt to EBITDA (at acquisition): | 4.3x |

| Net Debt to EBITDA (at exit): | 3.1x |

| CD&R Operating Partners: | Vindi Banga and Jim Berges |

| Status: | Fully Realized |

| Website: | www.diversey.com |