-

David’s Bridal is the largest specialty retailer of bridal gown and wedding-related apparel and accessories in the United States.

David’s Bridal is the largest specialty retailer of bridal gown and wedding-related apparel and accessories in the United States.

Strengthening a market-leading specialty retailer by expanding higher price point product offering; enhancing merchandising and pricing capabilities; pursuing product and service adjacencies and international growth

David’s Bridal’s unique product offering, high-touch service model, relatively low fashion risk, and exceptional market position distinguish the company in the specialty retail space, a category in which CD&R has very successfully invested in the past. David’s Bridal is the dominant player in the “value” segment of bridal gowns, with a national retail store network that draws approximately 80 percent of brides looking for dresses under $600. More recently, the company has expanded its reach into higher price segments of the market,

beginning with a partnership with industry icon Vera Wang to create an exclusive line for David’s Bridal priced between $800 and $2,000. This strategy has opened up a highly attractive and previously underserved market segment for the company which has been followed by additional brand launches at similar price points.

Since Fund VIII’s acquisition, the company has pushed against some difficult demographic headwinds related to marriage activity, which combined with changes to the company’s marketing and promotion strategies, negatively impacted profitability, but the business has stabilized, and management is executing several growth and productivity initiatives designed to return David’s Bridal to its historical earnings trajectory.

-

Key Achievements

- Upgraded management team with top talent and revised field organization and compensation structures to drive productivity

- Introduced additional bridal lines and improved style selection to better meet demands across price points and continue strong growth in the higher price point category ($1,000+)

- Developed a detailed customer segmentation system-wide and by market to inform sales strategies and to optimize real estate selection for store expansion plan

- Opened first store in the U.K. in October 2013 with positive performance to date

Company Profile

David’s Bridal is the largest specialty retailer of bridal gown and wedding-related apparel and accessories in the United States. With a network of 325 retail stores (313 in U.S., 11 in Canada, 1 in the U.K.), the company has the largest, and only national, U.S. footprint in wedding gown retail with an estimated 35% unit share in an otherwise highly fragmented market. Bridal retail is characterized by historical long-term market stability, highly specialized manufacturing, and discerning customers that require high service levels, product knowledge and product quality. These characteristics create strong barriers to entry and substantially mitigate the threat of disintermediation from Internet-based sales.

David’s Bridal designs, produces and sells bridal gowns and wedding apparel through a portfolio of owned and

exclusive brands and has the highest brand recognition in the industry, with 84% aided awareness. In addition to bridal gowns, the company offers a broad assortment of bridal apparel and accessories, bridesmaid dresses, and special occasion dresses, creating continued opportunity to increase attachment rates for gown customers to other products serving the bridal party.

David’s Bridal has developed leading supply chain capabilities that support its ability to scale and sustain its competitive advantages against other players. The company’s bridal gowns and other wedding party-related dresses are produced overseas through joint ventures with longstanding vendor partners. This integrated supply chain not only provides a cost advantage, but also enables the company to: (i) strictly control quality standards; (ii) deliver on shorter product lead times; and (iii) flex manufacturing to better reflect customer demand. Further, over time the company has built full in-house design

-

capabilities to support a fully proprietary bridal product offering and accelerate product time-to-market. The result is a vertically integrated bridal design, production and retail platform that is unmatched in the industry. Taken together with its leading market presence, the company’s value chain uniquely enables it to offer a portfolio of proprietary brands, including through valuable licensing partnerships with branded designers such as Vera Wang and Zac Posen.

Transaction Background

In October 2012, CD&R Fund VIII acquired David’s Bridal following a period of exclusive due diligence borne out of a broken auction process. At close, Fund VIII controlled the company with 74% of the equity, and the seller

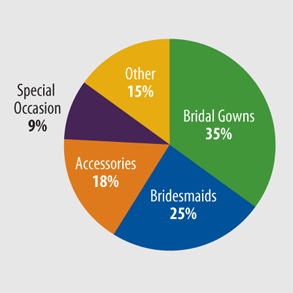

2014 Revenue by Category

2014 Revenue by Category

(Leonard Green & Partners) retained a portion of its equity for a continuing 25% stake. CD&R’s retail expertise, operational background, and knowledge of the business were key factors in positioning the Firm as the preferred buyer. As chairman of the company, CD&R Operating Partner Paul Pressler, former CEO of the Gap, Inc., is helping the management team execute upon the key operating and strategic initiatives that will drive top-line growth and profitability expansion.

Value Building Initiatives

CD&R and the David’s Bridal management team believe there are significant opportunities to build upon the company’s dominant market position and have identified several initiatives to improve top-line growth, profitability and efficiency:

-

- Strengthen Product Offering. Refocus on core value segment and refine assortment to better balance style offerings. Introduction of additional bridal lines to support the value proposition across price points and expand assortment beyond $1,000 to accelerate market share gains. Improve ancillary product offerings both in the store and online, including shifting mix for new bridesmaid offerings and fixing the accessories segment to drive better attachment rates.

- Customer Experience. Development of new store model designed to enhance customer / brand experience. Revising registration process and appointment booking to simplify process and optimize time allocation.

- Pricing and Promotional Strategy. Continue testing new promotional strategies and calendar to drive traffic with minimal margin concessions. Evaluate pricing architecture to enhance conversion and attachment rates. Optimize marketing investments, including digital / social media channels.

- Store Operations Redesign. Revamping store / sales processes and field management structures to simplify processes and reduce costs. Polling social media to monitor and improve store-level satisfaction.

- International Expansion. U.K. market opportunity - highly fragmented market with no major bridal retailer and similar bridal gown dynamics as North America; first store opened in October 2013 to strong results. Exploring adding additional locations in Canada and market expansion into Latin America.

Looking Forward

- Since Fund VIII’s acquisition, the company has faced difficult demographic trends as it relates to overall marriage activity. These trends, in turn, have pressured customer traffic and sales volumes, particularly in the company’s core value gown segment. Management has implemented several actions to drive traffic back to the company’s stores and website, including:

- Increased TV advertising; management continues to evaluate the company’s pricing and promotional structure in order to optimize marketing spend;

- The recent launch of a new bridal line and impending launch of an additional line in 2015 that will support the $600 - $1,000 tier and allow the company to reinforce its strong value proposition;

-

- Plans to expand the company’s assortment of higher price point gowns where the David’s Bridal has seen strong growth; and

- The recent completion of a new website platform and a mobile application is expected to support eCommerce growth and provide for an improved customer experience.

Investment Characteristics

| Investment Period: | October 2012 - Current |

| Industry: | Wedding-Related Apparel Retail |

| Seller: | Leonard Green & Partners |

| Purchase Price: | $1.1B |

| Purchase Multiple: | 9.4x LTM Adjusted EBITDA of $116.8M |

| CD&R Equity Investment: | $234M (Fund VIII) |

| CD&R Equity Ownership: | 74% (at acquisition) |

| Net Debt to Financing EBITDA (at acquisition): | 6.4x |

| CD&R Operating Partner: | Paul Pressler |

| Status: | Private Unrealized |

| Website: | www.davidsbridal.com |

Summary Financials

| PF At Acq. | Pro Forma | ||

| September 30 | Twelve months ended Dec. 31 | ||

| (millions) | 2012 | 2013 | 2014 |