-

ServiceMaster serves customers through a global network of approximately 8,000 company-owned locations and franchise and license agreements under several market-leading brands.

ServiceMaster serves customers through a global network of approximately 8,000 company-owned locations and franchise and license agreements under several market-leading brands.

Optimizing the profitability of a collection of leading consumer brands

CD&R Fund VII and Fund VII (Co-Investment) acquired ServiceMaster with the conviction that the company’s market-leading consumer brands needed renewed strategic emphasis and a better cost structure to increase profitability. Leveraging historical success in transforming branch-based, multi-location businesses, CD&R guided ServiceMaster through the challenging post-financial crisis economy and improved operating performance. The combination of new management talent, substantial cost and productivity initiatives, a renewed focus on improving the customer experience, and significant IT investments set the foundation for a successful June 2014 IPO

and subsequent secondary offerings in February and May 2015. The company’s stock currently trades publicly on the NYSE under the ticker symbol SERV. Since CD&R’s acquisition, Adjusted EBITDA has grown 71%, including more than 550bps of margin expansion.1

Company Profile

ServiceMaster is a leading provider of essential residential and commercial services, operating through an extensive service network of more than 8,000 company-owned locations and franchise and license agreements. The company has leading market positions across the majority of its markets. Its portfolio of well-recognized brands includes Terminix (termite and pest control), American Home Shield (home warranties), ServiceMaster Restore (disaster restoration), ServiceMaster Clean (janitorial),

-

Key Achievements

- Recruited and significantly enhanced senior leadership team

- Consolidated finance and administrative resources into Memphis HQ

- Invested heavily in IT to improve the customer experience and drive route efficiencies and economics

- Streamlined portfolio through divestitures of InStar and LandCare, and the spin-off of TruGreen

- Adjusted EBITDA margins up 550 bps since acquisition (pro forma for the divestitures and spin-off)

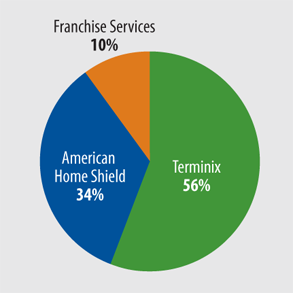

Merry Maids (residential cleaning), Furniture Medic (furniture repair) and AmeriSpec (home inspections). The company serves its residential and commercial customers through an employee base of approximately 13,000 company associates. In 2014, the company generated approximately $2.5 billion in annual revenue, pro forma for the TruGreen spin-off, broken down in the pie chart at right.

A Long Sourcing Process Pays Off

Like many CD&R investments, ServiceMaster was the product of multi-year sourcing. In 2004, the Firm identified ServiceMaster’s attractive end markets and strong market position but saw poor execution as a potentially compelling opportunity for CD&R’s investment strategy and skill set.

2014 Revenue

2014 Revenue

-

When the company subsequently received an unsolicited offer from a strategic buyer in 2005, CD&R was invited by ServiceMaster’s board of directors to perform additional due diligence and submit a formal offer for the business. While CD&R’s offer subsequently was deemed unacceptable and the company terminated the sale process, the Firm’s diligence confirmed the original investment thesis and the Firm continued to follow the situation closely. When ServiceMaster later recruited a new CEO, CD&R informed him of the Firm’s continued interest in the company and, given the Firm’s significant prior work, CD&R was in a strong position to accurately assess the business and drive the sale process to a relatively fast conclusion.

Value Building Strategies

CD&R’s deep experience with business transformations involving branded businesses operating in multi-location

ServiceMaster Stock Price Performance

formats, such as Kinko’s, Hertz and Sally Beauty, has been directly relevant to ServiceMaster. Against a challenging macroeconomic backdrop, the performance and resilience of ServiceMaster has been positive. Key initiatives executed to date or in progress include:

- Upgraded senior leadership. Since our investment, we have strengthened the senior leadership team by recruiting a new CEO, CFO and a president for each business unit, as well as upgrading the talent of each of the corporate functions.

-

- Grow customer base. ServiceMaster is making strategic investments in sales, marketing and advertising to drive new business leads, brand awareness and market penetration. Multiple initiatives to improve customer satisfaction and service delivery are also underway, which will continue to support improved retention and growth in the customer base.

- Introduce new service offerings. ServiceMaster leverages its existing sales channels and local coverage to deliver additional value-added services to its customers. Recent launches such as crawlspace encapsulation, mosquito control and wildlife exclusion at Terminix have shown solid results and are expected to contribute to above-market growth going forward.

- Grow commercial business. Terminix has assembled a dedicated commercial sales team to leverage ServiceMaster’s national coverage, brand strength and broad service offerings to target large multi-regional accounts.

- Enhance profitability. ServiceMaster has been able to increase productivity across segments through actions such as continuous process improvement, targeted systems investments, sales force initiatives and technician mobility tools. The company is also applying strategic sourcing to drive more favorable pricing and terms on its $1.3 billion of addressable annual spend.

The net effect of these initiatives to date has been a 71% increase in EBITDA and 550 bps of EBITDA margin expansion since acquisition.

A Public Success

With the consistent execution of its key initiatives and the positioning of the business following the spin-off of TruGreen, the company successfully completed an initial public offering of its common stock at $17.00 per share in June 2014.

The company’s stock currently trades publicly on the NYSE under the ticker symbol SERV. ServiceMaster’s positive operating trends and strong share price performance post-IPO provided the foundation for the company’s successful execution of secondary offerings in February and May 2015. To date, CD&R affiliated funds have received approximately $1.0 billion in net proceeds from the ServiceMaster investment, or 1.5x the investment’s pro forma cost basis, and CD&R affiliated funds continue to own approximately 19% of the company’s common stock.2

Investment Characteristics

| Investment Period: | July 2007 - Current |

| Industry: | Consumer and Commercial Services |

| Seller: | Public Company |

| Original Investment Date: | Jul-07 |

| Purchase Price: | $5.7B |

| Purchase Multiple: | 12.4x LTM Adjusted EBITDA |

| CD&R Equity Investment: | $747M (Fund VII and Fund VII (Co-Investment) |

| CD&R Equity Ownership: | 60% (at acquisition), including LP third-party co-investment |

| Net Debt to EBITDA (acquisition): | 9.1x |

| CD&R Operating Partner: | John Krenicki |

| Status: | Partially Realized; Publicly-Traded |

| Website: | www.servicemaster.com |

Summary Financials

| (millions) | Acq. 6/30/2007 |

2013* | 2014 |