-

Mauser is one of the world’s leading global manufacturers and suppliers of plastic and steel drums, intermediate bulk containers (“IBCs”) and associated reconditioning services.

Mauser is one of the world’s leading global manufacturers and suppliers of plastic and steel drums, intermediate bulk containers (“IBCs”) and associated reconditioning services.

A leading global manufacturer of industrial packaging and associated reconditioning services

Mauser Group (“Mauser”) exhibits many hallmarks of a prototypical CD&R investment: a market-leading competitive position, a high service content business model, stable customer demand, broad spread of risk and potential for ongoing operational improvement. CD&R leveraged a distinct knowledge advantage during the due diligence process for Mauser - two CD&R portfolio companies, Univar (Fund VIII) and Solenis (Fund IX), are both customers of the company. This insight, along with CD&R’s deep industrial knowledge in both the US and Europe, played a key role in positioning CD&R to purchase Mauser in a €1.2

billion transaction which closed in July 2014. While still early in the life of the Fund IX investment, Mauser has performed well to date, with EBITDA up approximately 13% in 2014, and is operating above CD&R’s original investment case, which CD&R believes will set the stage for continued value creation and multiple paths to exit.

Company Profile

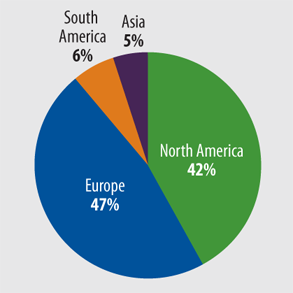

Mauser is one of the world’s leading global manufacturers and suppliers of plastic and steel drums, intermediate bulk containers (“IBCs”) and associated reconditioning services. The Company’s products are used by customers in a wide variety of end markets, including the chemical, industrial and food & beverage industries, among others. Mauser’s 4,400 employees operate 83 production facilities across 18 countries

-

Key Achievements

- Upgraded North American leadership and formed newly-created COO role

- Pursued growth investments in select product lines and geographies given strong momentum of business (e.g. new IBC lines in Turkey and US)

- Acquired a smaller US competitor operating in Mauser’s core markets IBC and Reconditioning

- Sold underperforming factories

in Europe, North America, Latin America and Asia. The rigid industrial packaging industry is consolidated globally, with the top three players accounting for more than 60% of the market. Each of the three main competitors has

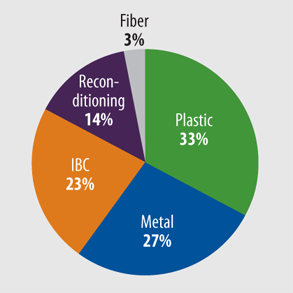

a distinct position in one or two segments - Mauser has built strong positions in the attractive plastic and reconditioning services sub-segments, which are characterized by a high service component and stronger relative growth rates and profitability. Mauser’s reconditioning service capabilities allow the company to offer a unique life-cycle solution to its customers, which in turn has increased growth and customer stickiness.

The industry is further characterized by historically stable demand - largely tied to industrial/chemical production, contractual pass-through of changes to raw material prices and high barriers to entry, in particular with regard to capital, quality certifications and established geographic footprints. Over the past 5 years, the company delivered a sales growth CAGR of 9% and EBITDA growth CAGR of 13%.

Transaction Overview

Through a multi-year sourcing effort, which included leveraging CD&R’s deep industrial expertise and a distinct knowledge advantage during the due diligence process - two CD&R portfolio companies, Univar (Fund VIII) and Solenis (Fund IX), are both customers of Mauser - CD&R acquired Mauser in a €1.2 billion transaction which closed in July 2014. CD&R Operating Partner Vindi Banga serves as Chairman of the Supervisory Board. CD&R believes Mauser represents a well-positioned and relatively stable industrial business with opportunities to improve operational execution through initiatives that CD&R has successfully implemented in other portfolio companies in the past, such as realizing cost and productivity improvements, and pursuing accretive acquisitions along with supporting the growth of the reconditioning services business globally.

-

Value Building Initiatives

Management and CD&R identified and are executing several strategic and operating initiatives:

- Re-energize US business. Mauser’s North American business is the Group’s largest EBITDA contributor and while delivering positive year-on-year EBITDA growth of +6%, lost some momentum over the last year due to leadership issues. Newly hired Head of SBU North America is tasked to re-energize growth.

- Implement cost saving and efficiency projects focusing on procurement and supply chain savings. Management is actively pursuing raw material, energy & freight and other cost savings.

- Keep special focus on underperforming units and respective turnaround processes. Mauser has aggressively tackled profitability issues in its French

- and Latin American operations over the last few years and is actively managing underperforming units.

Sales By Product

Sales By Product

- Continue sharing best practices across all regions. Management is sharing best practices across regions, most notably on cost efficiency, product development and innovation. For example, the profitability of Mauser’s European Reconditioning business is well below the North American operations. Management is implementing initiatives to reduce this profitability gap.

- Ensure working capital improvements and increase overall focus on cash flow. Mauser has set up a business intelligence system with working capital KPIs (DIO, DSO, and DPO) with drill-down by plant, customers and suppliers to enhance focus on cash flows. Management’s incentive system has been adjusted to reflect this focus.

- Focus on Sustainability. Investment in renewable energy sources generated EEG savings of about €4m p.a. in 2014. Mauser is also significantly increasing the environmentally friendly usage of post-consumer resin (+11% vs prior year in 2014).

-

Sales By Geography

Sales By Geography

Looking Forward

- Mauser expects attractive organic growth for its product categories in Europe, North America, South America and Asia and is looking for additional growth opportunities on a continuous basis.

- Balancing the company’s growth prospects, the management team and CD&R are also actively pursuing various cost-savings and efficiency initiatives, which are designed to further strengthen Mauser’s operating profile.

Investment Characteristics

| Investment Period: | July 2014 - Current |

| Industry: | Rigid Industrial Packaging |

| Seller: | Dubai International Capital |

| Purchase Price: | €1.2B |

| Purchase Multiple: | 7.6x Adjusted LTM 3/31/14 EBITDA of €154M |

| CD&R Equity Investment: | $320M (Fund IX) |

| CD&R Equity Ownership: | 97% (at acquisition, Fund IX only) |

| Net Debt to EBITDA (at acquisition): | 6.2x Adjusted LTM 3/31/14 EBITDA |

| CD&R Operating Partner: | Vindi Banga |

| Status: | Private Unrealized |

| Website: | www.mausergroup.com |

Summary Financials

| Twelve months ended Dec. 31, | |||

| Acq. (Jul '14) | 2013 | 2014 | |