-

Brand Energy & Infrastructure Services, Inc. is a leading provider of specialized services to the global energy, industrial and infrastructure markets.

Brand Energy & Infrastructure Services, Inc. is a leading provider of specialized services to the global energy, industrial and infrastructure markets.

Transitioning focus to accelerating growth after successfully combining and integrating two businesses to create a global leader in industrial and infrastructure services

Brand, a leading provider of specialized services to the global energy, industrial and infrastructure markets, was formed through the concurrent acquisition and combination of the Infrastructure segment of Harsco Corporation and Brand Energy & Infrastructure Services. After negotiating a proprietary carve-out partnership transaction for Harsco’s infrastructure business, CD&R temporarily postponed the closing to preempt a formal dual-track IPO and sale process that was set to launch for Brand Energy & Infrastructure

Services - a larger, highly complementary, well positioned domestic competitor. After The Company has significant opportunity to grow through expanding its scope of services and share of wallet with current customers globally while further optimizing its existing footprint and operations.

Fund IX’s investment is structured with many of the key attributes that characterize the Firm’s partnership investments: a liquidation preference and contractual cash/ownership transfer payments that were replicated through an equityholders’ agreement with Harsco, operational control and the ability to capture equity upside in the business through a controlling 71% common equity stake.

-

Key Achievements

- Completed key functional and operational integration of Brand and Harsco Infrastructure

- Made significant progress in optimizing the combined business through consolidating the existing footprint and exiting select markets

- Closed two accretive tuck-in acquisitions and built a pipeline of additional opportunities

- Achieved strong earnings growth ahead of plan

- Realized ~$7 million of annual net synergies to date and targeting an additional $5 million in 2015

Company Profile

Operating in more than 360 locations worldwide, Brand Energy & Infrastructure Services, Inc. (the “Company”)

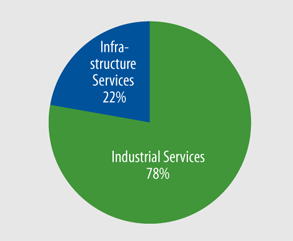

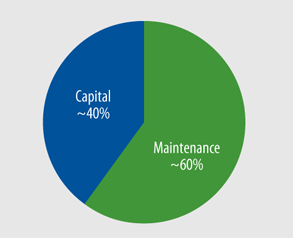

is a leading provider of specialized services to the global energy, industrial and infrastructure markets. Approximately 78% of the Company’s over $3 billion of revenue is derived from an integrated suite of specialty industrial services, including the erection and dismantling of industrial scaffolding and a wide offering of industrial services, such as coating, painting, abrasive blasting, insulation, refractory, corrosion protection, weatherproofing and fireproofing to support the maintenance, inspection and overhaul of customers’ industrial facilities. The remaining 22% of revenue comes from infrastructure services and is comprised of sales and rentals of concrete formwork and shoring systems and related engineering services for the erection, development, maintenance and repair of civil and industrial infrastructure, such as dams and bridges and non-residential and residential high-rise buildings. Approximately 60% of the company’s revenue is tied to customers’ recurring maintenance activities, with the balance from capital expansion

projects, which are exposed to the new industrial plant construction cycle and a potential rebound in commercial construction activity globally.

Brand Energy & Infrastructure Services at a Glance

Brand Energy & Infrastructure Services at a Glance

By Business -

Transaction Overview

In November 2013, CD&R led an investment to acquire and combine Brand Energy & Infrastructure Services, Inc. with Harsco Corporation’s Infrastructure division. Simultan- eously at close, Brand completed a tuck-in acquisition of Gregg Industries resulting in a total transaction enterprise valuation of $2.6 billion. CD&R Fund IX and affiliates invested $543 million for a 71% ownership stake in the combined business, which continued to use the name Brand Energy & Infrastructure Services. Harsco retained a 29% ownership interest. The transaction was exclusive to CD&R, valued at approximately $2.6 billion and created a leading, single-source provider of specialized industrial services worldwide to the energy and infrastructure sectors. CD&R Operating Partner John Krenicki, former Vice Chairman of GE who led the company’s ~$50 billion energy business, serves as Lead Director of Brand. In connection with the investment, CD&R replicated the core

economics of many of its partnership transactions by negotiating an equityholders’ agreement with Harsco

Brand Energy & Infrastructure Services at a Glance

Brand Energy & Infrastructure Services at a Glance

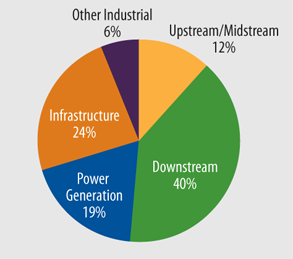

By End Marketthat provides for approximately $23 million in annual transfers of cash or equity interests from Harsco to CD&R. In addition, Harsco has agreed to provide priority distributions to CD&R in certain situations.

Value Building Initiatives

The Brand management team is pursuing several initiatives to improve top-line growth, profitability and efficiency:

- Business Integration. Key integration of Brand and Harsco Infrastructure complete with focus turning to remaining cost and revenue synergies. Have achieved ~$7 million of annual net synergies to date, with an incremental $5 million expected in 2015 and a total potential of $20-40 million, including revenue synergies. Executing on restructuring of international operations including exiting some unprofitable regions.

-

- Growth Initiatives. Increase penetration of higher-end service offerings at existing customer facilities, expanding maintenance and services share of wallet. Continue to expand specialty industrial services capabilities. Utilize global platform to provide services to existing customers in new geographies and to expand the number of services provided to customers outside of North America.

- Contract Management & Pricing. Implement procedures to enhance bidding strategy and approach across entire platform, more accurately assessing pricing and profitability. Improve processes to manage long-term client relationships, contracts, and projects, including increased bundling and cross-selling of services where appropriate.

- Capital Efficiency. Leverage global scale in procurement and management of equipment. Actively manage asset utilization to maximize productivity of

idle equipment and more effectively manage capital spend. Significant focus on working capital management, particularly receivables and inventories.

Brand Energy & Infrastructure Services at a Glance

Brand Energy & Infrastructure Services at a Glance

By Funding Type- Formwork Sourcing. Leverage Hünnebeck (legacy Harsco) formwork technology and capabilities to improve asset base and expand addressable market in North America.

- Strategic Acquisitions. Expanding internal M&A capabilities and team to identify landscape of opportunities and prioritize target pipeline. Evaluating opportunistic acquisition opportunities with a focus on extending footprint and capabilities.

Looking Forward

- Management continues to execute on the restructuring of certain international operations, including exits from some unprofitable businesses / geographies

- Strategic focus will shift during 2015 from integration and restructuring to optimization and growth, capturing incremental synergy opportunities

-

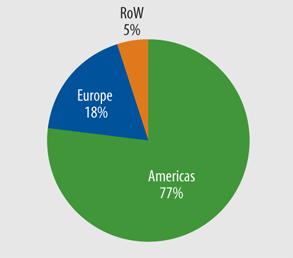

Brand Energy & Infrastructure Services at a Glance

Brand Energy & Infrastructure Services at a Glance

By Geography- Management continues to opportunistically pursue strategic acquisitions

- Core business momentum remains solid but near-term headwinds are expected from the challenging FX environment and project deferrals by the Company’s customers due to challenging commodity price environments

Investment Characteristics

| Investment Period: | November 2013 - current |

| Industry: | Specialized industrial services |

| Seller: | Harsco and First Reserve (Brand Energy) |

| Purchase Price: | $2.6 billion |

| Purchase Multiple: | 8.0x 2013 PF Combined Adjusted EBITDA of $324 million (including $7 million of net synergies) |

| CD&R Equity Investment: | $543 million (Fund IX and affiliates) |

| CD&R Equity Ownership: | 71% (at acquistion) |

| Net Debt to EBITDA (at acquisition): | 5.6x 2013 PF Combined Adjusted EBITDA |

| CD&R Operating Partner: | John Krenicki |

| Status: | Private Unrealized |

| Website: | www.beis.com |

Summary Financials

| Twelve months ended Dec. 31, | ||

| (millions) | PF 2014 (a) | PF 2013 (b) |