-

Atkore International is a leading global manufacturer of fabricated steel tubes and pipes, pre-wired armored cables, cable management systems and metal framing systems.

Atkore International is a leading global manufacturer of fabricated steel tubes and pipes, pre-wired armored cables, cable management systems and metal framing systems.

Executing on a value creation roadmap based on organizational redesign, management upgrades, portfolio rebalancing, new operating tools and metrics, margin improvement initiatives and targeted growth opportunities

In 2010, Tyco International selected CD&R as its equity partner in the spin-off of Tyco’s Electrical and Metal Products division into a standalone private company renamed Atkore International. While sourcing and evaluating the transaction, CD&R leveraged its experience in construction-related manufacturing and distribution businesses from prior investments in WESCO, Rexel and NCI, among others, to develop unique insights into the business.

With that background, CD&R proposed a partnership transaction with several attractive merits for Tyco, including upfront cash proceeds,the deconsolidation of a non-core business from Tyco’s financials, and the ability for Tyco to retain future equity upside. In addition, CD&R’s track record of successful corporate carve-outs, reputation for operating capabilities and pre-existing relationship with senior Tyco management were critical in building trust and credibility in CD&R as a long-term partner.

For CD&R, the Atkore investment reflects the attractive risk-reward attributes of the Firm’s partnership-oriented investments: senior equity

-

position in a low leverage capital structure, a dividend-paying security, operational control and the ability to convert into common stock to capture the upside in equity value creation over time.

Subsequently, in April 2014, Atkore repurchased all of Tyco’s 29 million common shares in Atkore for $250 million. Concurrently, Fund VIII’s existing preferred stock was converted into common equity, and Fund VIII now owns approximately 89% of Atkore’s fully diluted equity. CD&R believes Atkore is currently well positioned to capitalize on an eventual market recovery in non-residential construction activity.

Key Achievements

- Redesigned the organization structure to more effectively align with customers / channels and position the business for greater long-term strategic optionality

- Upgraded the management team (over 60% of the top 140 managers are new) with renewed energy, leadership and focus

- Refocused strategic direction and invested in marketing and sales resources supporting Electrical Raceway offering and value proposition

- Significant reshaping of the portfolio through acquisitions of strategic and value-added businesses and divested underperforming or poorly positioned businesses

- Development of the Atkore Business System to drive commercial excellence, business alignment and overall performance

Company Profile

Atkore International is a leading manufacturer of Electrical Raceway products that deploy, isolate, and protect a structure’s electrical circuitry in non-residential construction infrastructure from “curb-to-outlet.” Primarily installed in construction applications, the Company’s core Electrical Raceway products include: steel, stainless steel, aluminum, and PVC electrical conduit; armored and metal-clad cable; liquid-tight and flexible conduit; cable tray and cable ladder; and support systems that support Atkore’s other products and solutions. The Company’s mission is to be the customer’s first choice for Electrical Raceway and complementary high value products by providing unmatched quality and delivery through the electrical distribution channel. Atkore enjoys a strong market position in most of its core strategic Electrical Raceway markets, namely: #1 in steel conduit, #1 in armored cable, #1 in cable and Electrical Raceway supports, and #2 in PVC conduit.

-

The Company distributes products to end-users, typically trade contractors, through several distinct channels, primarily electrical distributors, but also industrial distributors, HVAC and plumbing distributors, datacom distributors, home improvement retailers and original equipment manufacturers, as well as directly to a small number of general contractors. The breadth and complementary portfolio of Electrical Raceway products, combined with its strong brands and entrenched market positions in the electrical distribution channel, afford the Company a meaningful competitive advantage and position it well for further growth and portfolio expansion.

Transaction Background

On December 22, 2010, CD&R Fund VIII acquired an initial 51% ownership stake in Atkore International, formerly known as the Electrical and Metal Products division of

Tyco International Ltd. The business had previouslyoperated as a non-core division of Tyco. Tyco retained an initial 49% ownership stake in Atkore through a common equity security that ranked junior to Fund VIII’s preferred equity investment. From the outset, CD&R controlled a majority of the Board and Operating Advisor Phil Knisely serves as Chairman of Atkore.

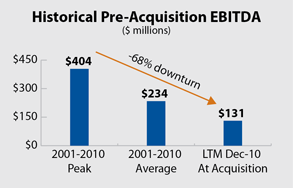

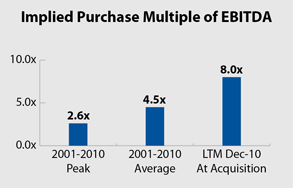

Similar to CD&R’s other partnership investments, the risk/return profile of this transaction is particularly attractive due to both its valuation (approximately 2.6x peak historical EBITDA and approximately 4.5x 10-year average EBITDA) and its unique structure. CD&R Fund VIII’s investment in a convertible preferred security with a current coupon and a capital structure with low leverage, only a springing financial

-

maintenance covenant for the benefit of ABL lenders and significant liquidity provided substantial upside opportunity as well as meaningful downside protection.

Through the first three years of ownership, CD&R received all dividends on its preferred stock in additional shares of the Company, thereby increasing CD&R’s ownership of Atkore. On April 9, 2014, Atkore repurchased Tyco’s remaining 37% equity stake in the Company for $250 million, implying an enterprise value of approximately 8.4x EBITDA. To fund the transaction and recapitalize its balance sheet, Atkore issued new term loans at attractive rates, resulting in only a slight increase in total interest expense. Concurrent with the transaction, CD&R converted its preferred stock into common shares that now represent 89% ownership on a fully diluted basis. The transaction simplifies the governance process and increases flexibility around exit given the simplified capital structure with prepayable debt.

Value Building Initiatives

CD&R and the Atkore management team have identified several discrete initiatives to improve top-line growth, profitability and efficiency, and they can be aggregated into the following broad categories:

- Driving Electrical Raceway strategy. Position Atkore strategically as a customer’s single-source comprehensive solutions provider to drive sales of higher margin products and capture higher customer wallet share.

- Organizational redesign and talent upgrades. Realigning key positions and business units to improve operating focus, leadership and accountability and upgrading management talent throughout the organization (over 60% of the top 140 positions are new to Atkore or their position since 2011).

- Improving profitability of struggling businesses. Improving profitability of sprinkler business, restructuring European operations and positioning APAC business for success.

- Portfolio rebalancing. Investing behind and enhancing well-positioned segments and value-added products, while divesting or exiting businesses with poor competitive profiles.

- Manufacturing optimization and SG&A reduction. Evaluating existing manufacturing footprint for consolidation or optimization opportunities and implementing modern manufacturing techniques (LEAN, SMED, etc.) to drive efficiencies.

- Working capital improvements. Focus on receivables collections and payable extensions and a global effort to drive inventory reduction through improved demand forecasting and production schedules.

-

- Targeted, strategic growth opportunities. Targeting new customers and end markets and seeking strategic partnerships and tuck-in acquisitions that are complementary to the Electrical Raceway strategy.

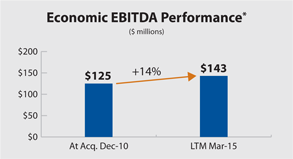

*Economic EBITDA is a metric used by management that substitutes an estimate of current period, current market steel raw material costs in the Pipe, Tube and Conduit business for accounting cost, which is done on a FIFO basis.

*Economic EBITDA is a metric used by management that substitutes an estimate of current period, current market steel raw material costs in the Pipe, Tube and Conduit business for accounting cost, which is done on a FIFO basis.

Looking Forward

Atkore has improved its business mix under CD&R Fund VIII’s ownership and has substantially upgraded the management talent throughout the organization. Management has developed and is employing new financial and operating tools to manage and monitor profitability and is developing a culture focused on top-line growth, margin improvement and cash flow generation. McGraw-Hill and other sources are forecasting improvement in non-residential construction starts in 2015, and Atkore is focused on capitalizing on anticipated recovery. The Company expects that operating results over the medium-term will be characterized by sales growth in excess of market growth as a result of geographic and product-based initiatives and continued focus on the Electrical Raceway strategy, cost structure improvements and operating leverage.

Investment Characteristics

| Investment Period: | December 2010 - Current |

| Industry: | Electrical and Metal Products |

| Seller: | Tyco International |

| Purchase Price: | $1.05B |

| Purchase Multiple: | 8.0x LTM Adjusted EBITDA of $131M |

| CD&R Equity Investment: | $305M (Fund VIII) - Preferred Equity |

| CD&R Equity Ownership: | 51% (at acquisition) |

| Net Debt to EBITDA (at acquisition): | 3.3x |

| CD&R Operating Partner: | Jim Berges |

| CD&R Operating Advisor: | Phil Knisely |

| Status: | Private Unrealized |

| Website: | www.atkore.com |

Summary Financials

| Last twelve months | At Acquisition | |||

| (millions; FY Sep) | (12/31/14) | Sep. 30, 2014 | Dec. 22, 2010 | |