-

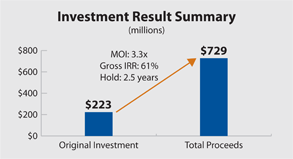

Fully Realized: 3.3x

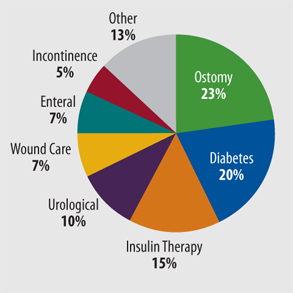

AssuraMed offers more than 30,000 products addressing a diverse set of rapidly growing chronic disease market segments.

AssuraMed offers more than 30,000 products addressing a diverse set of rapidly growing chronic disease market segments.

Enhanced a highly attractive platform by strengthening the management team, upgrading the company’s systems and process disciplines, and pursuing strategic acquisitions, which led to Fund VIII’s sale of AssuraMed to Cardinal Health in a transaction that generated a 61% gross IRR and 3.3x multiple of investment

Prior to CD&R Fund VIII’s acquisition in 2010, AssuraMed was a family-owned, mail-order medical supplies business that had long outgrown its small entrepreneurial roots. Yet it was highly successful, rapidly growing and benefitting from secular trends driving more healthcare into the home. In addition to new patient growth, the annuity-like ordering habits of chronic disease patients, the company’s

strong service capabilities and high end-user retention resulted in very stable and recurring revenue streams.

After acquiring the business, CD&R made significant strategic investments in senior leadership and infrastructure to support accelerated growth initiatives that leveraged the company’s competitive advantages and capitalized on favorable industry trends, including the aging population, growing frequency of chronic diseases, steady flow of new products and a continued push toward the home healthcare channel. In addition, AssuraMed implemented operational value creation initiatives such as category management, private label, and customer and product mix management.

-

As a result of AssuraMed’s strong performance and differentiated and value-added distribution capabilities, Cardinal Health saw the business as a key platform opportunity in the growing home healthcare channel and agreed to acquire the company in a $2.1 billion transaction in March 2013. Total proceeds to Fund VIII from this transaction and a prior dividend were $729 million, representing a 3.3x MOI and a 61% gross IRR.

Company Profile

AssuraMed is the largest direct-to-home provider of disposable medical products serving chronic disease patients in the United States. AssuraMed’s product

offering is one of the broadest and deepest in the specialty medical supply industry, often providing hard-to-find products that other home care suppliers do not carry. The company offers its large and fragmented customer base more than 30,000 products addressing a diverse set of rapidly growing chronic disease market segments including ostomy, diabetes, urological, enteral nutrition and feeding supplies, incontinence and wound care. Through the company’s twelve distribution facilities (pro forma for ISG), AssuraMed offers one-to-two day ground shipping service to 99% of the U.S. population.

The company operates a unique business model with two operating segments that leverage the same vendor relationships, product offering, distribution infrastructure, IT systems, and other back-office functions, but utilize different go-to-market strategies to access the chronic disease patient population:

-

- Edgepark (45% of sales): contracts directly with over 600 managed care organizations (MCOs) to provide direct-to-consumer home delivery of products to approximately 350,000 patients, while also providing MCOswith value-added services such as billing expertise and technology-based customer service that drives utilization and patient compliance.

- Independence (55% of sales): offers a just-in-time, outsourced supply chain, including lower costs, higher efficiencies and better return on investment for its approximately 5,800 commercial customers (durable medical equipment suppliers, pharmacies and wholesale distributors), providing home delivery to approximately 800,000 patients on behalf of its commercial customers, as well as delivery to commercial locations.

CD&R Investment Overview

In September 2010, CD&R Fund VIII acquired AssuraMed, Inc. (then known as HGI Holding, Inc.) in a transaction valued at $903 million (including fees and expenses), or 10.3x LTM Adjusted EBITDA. Adjusting for the present value associated with a previous 338(h)(10) election that provides for $29 million in annual cash tax deductions through 2021, the net transaction value was $832 million,

or 9.5x LTM Adjusted EBITDA. Fund VIII invested $223 million, or 52% of the total equity in the transaction (prior to dilution from management options) with the remainder of the equity owned by GS Capital Partners, mezzanine investors and management.

In October 2012, AssuraMed completed a $660 million refinancing, the proceeds of which, along with cash on hand, were used to: (i) repay existing debt; (ii) acquire Invacare Supply Group (ISG), a medical supplies business, for $150 million; and (iii) fund a $140 million dividend to AssuraMed shareholders, including $72 million to Fund VIII. The ISG acquisition closed and the dividend was distributed in January 2013.

In March 2013, Cardinal Health acquired AssuraMed in a $2.1 billion transaction, generating $656 million in proceeds to Fund VIII.

-

2012 Sales by Product Category

2012 Sales by Product Category

Value-Building Strategies

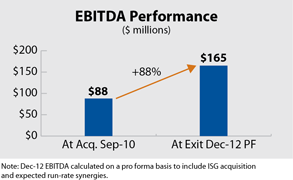

CD&R operating partner Paul Pressler served as Chairman of the company’s Board of Directors, and worked closely with the management team to improve business performance. The significant EBITDA growth experienced by AssuraMed during CD&R’s ownership period resulted from a combination of operating initiatives including:

- Enhanced management talent and functional expertise.

- Early investments to transform senior leadership team, most notably recruitment of Michael Petras as new CEO. Michael was a 19-year veteran of General Electric, where he ran GE’s lighting business, a 16,000 employee business with 33 manufacturing plants globally

- Additional talent upgrades included new head of Independence Medical, Chief Marketing Officer, VP of Legal, Directors of Human Resources, Category Management, Financial Planning & Analysis, Supply Chain, e-Commerce and Call Center

- Professionalizing sales.

- Realigned organization creating national account and geographic coverage, improved talent across sales teams, and added deep customer analytics to drive profitable product and customer mix

- Changed incentive structures to better manage volumes and margins

- Increased focus on selling AssuraMed value proposition to customers

- Enhanced management talent and functional expertise.

-

- Pricing optimization.

- Employed sophisticated pricing architecture and decision-making to define price sensitivities and increase margin

- Selectively increased prices across a range of product categories in both operating segments

- Category management.

- Introduced disciplines to focus on margin enhancement (both cost deflation and mix) by installing category managers with P&L responsibility and organized by disease state

- Broadened supplier relationships and drove private label and new product opportunities

- Upgraded systems, tools and processes.

- Implemented new ERP and CRM systems and added call center technologies

- Significantly improved patient analytics and enhanced patient interaction

The result was a 88% increase in LTM EBITDA from acquisition to December 31, 2012.

- Pricing optimization.

Investment Characteristics

| Investment Period: | September 2010 - March 2013 |

| Industry: | Medical Supplies Distribution |

| Seller: | The Jordan Company; Harrington Family |

| Purchase Price: | $832M (net of tax shield present value) |

| Purchase Multiple: | 9.5x LTM Adjusted EBITDA of $87.9M |

| CD&R Equity Investment: | $223M (Fund VIII) |

| CD&R Equity Ownership: | 52% (at acquisition); pre-dilution |

| Net Debt to EBITDA: | 5.4x (at acquisition) |

| CD&R Operating Partner: | Paul Pressler |

| Status: | Fully Realized |

| Website: | www.assuramed.com |