-

CHC is one of two global commercial operators of heavy and medium helicopters, providing transportation services for the offshore oil and gas industry.

CHC is one of two global commercial operators of heavy and medium helicopters, providing transportation services for the offshore oil and gas industry.

CD&R partnered with existing shareholders to strengthen CHC’s balance sheet and serve as a catalyst for renewed strategic focus and capital efficient growth of a leading offshore services provider to the global oil & gas industry

With its market leading competitive position in one of the most defensive subsectors of the oil and gas services industry, CD&R regularly tracked CHC’s performance for nearly a decade before investing in the business in 2014. In 2008, CHC was acquired by affiliates of First Reserve through a leveraged buyout structure, which the company struggled to outgrow as management prioritized growth at the expense of capital efficiency. When an early 2014 IPO raised less proceeds than originally planned, the company’s still overleveraged balance

sheet weighed heavily on its stock price post-IPO. With no obvious public market solution in hand, CD&R proactively proposed a capital injection led by CD&R Fund IX that deleveraged and strengthened the company’s balance sheet and provided CD&R operational leadership of the business.

Company Profile

CHC is one of two global commercial operators of heavy and medium helicopters, providing transportation services for the offshore oil and gas industry. The Company also provides emergency medical services (EMS) and search and rescue (SAR) operations, in addition to operating an associated maintenance and repair business. CHC’s customers include oil and gas companies, government search-and-rescue agencies and organizations requiring helicopter maintenance, repair

-

and overhaul services. The Company operates approximately 230 aircraft across 70 bases in 30 countries on six continents around the world. With approximately $1.7 billion in revenues, CHC conducts its services through two operating segments:

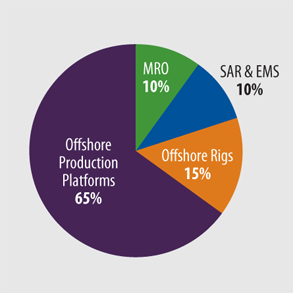

- Helicopter Services (~90% of revenues), which primarily facilitates large, long-distance crew changes on offshore production facilities and drilling rigs, and helicopter transportation for EMS and SAR operations involving oil and gas customers and government agencies; and

- Heli-One (~10% of revenues), which is the industry’s only large independent MRO operator providing helicopter maintenance services to both the Company’s helicopter fleet and third-party customers.

By Business Segment

By Business Segment

Transaction Overview

Through a series of closings during Q4 2014, CD&R Fund IX and affiliates invested $600 million in convertible preferred shares of CHC Group Ltd. Of the $600 million investment, Fund IX invested $400 million and LP co-investors invested $200 million. The convertible preferred equity carries an 8.5% annual dividend payable in-kind for two years and cash or in-kind thereafter, with an initial con-version price of $7.50 per share. At closing, CD&R Fund IX and co-investors owned 49.6% of CHC on an as-converted basis, while First Reserve retained an approximate 29% ownership interest, with the balance held by public shareholders and management.

Consistent with CD&R’s investment approach that emphasizes operating leadership, CD&R Operating Partner John Krenicki,

-

a former Vice Chairman of GE and CEO of GE Energy, serves as Chairman of the Board. John’s deep expertise in the energy sector was a key differentiator in sourcing this transaction and is valued by CHC’s management team and the Company’s largest existing shareholder, who worked together with CD&R to craft this transaction. In addition, CD&R has a right to appoint four of the company’s nine directors. Shortly after closing the transaction, CD&R recruited Karl Fessenden, a former GE Energy and Aerospace Services executive, to be the new CEO of CHC.

Investment Thesis

CD&R believes that the transaction, valued at approximately $3.3 billion (as adjusted for the company’s operating leased fleet), represents a compelling opportunity to invest behind a clear market leader in a

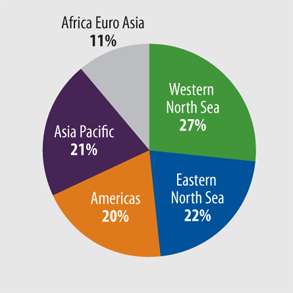

By Geography

By Geography

defensive subsector with favorable secular trends, strong competitive positioning and robust asset protection. More specifically, the key elements of CD&R’s investment thesis are:

- Market leading, global service provider with a blue chip customer base. CHC is one of only two major global transportation service providers in the industry. The Company primarily serves the world’s national and international oil companies and, in fiscal 2014, transported over 1 million passengers on approximately 86,000 flights. CHC is the only service provider in the industry with 100% of its fleet comprised of medium and heavy helicopters, which have higher passenger-carrying capacities, engine and pilot redundancy, and the ability to travel farther offshore and in more severe weather conditions.

-

- Attractive long-term demand drivers for offshore transportation services. Oil and gas are projected to account for approximately 50% of global energy consumption over the longer term, which in turn, is expected to be supported by increased deepwater and ultradeepwater production. The combination of growing platform counts, drilling activity further from shore, increasing personnel requirements and increased regulatory oversight is expected to drive growth in demand for offshore transportation services. Over the last 10 years, CHC has grown revenues and EBITDAR at 11.9% and 13.1% CAGRs, respectively.

- One of the most defensive subsectors in energy services. Transportation of personnel to drilling rigs is a mission critical, nondiscretionary service, yet it represents only approximately 5% of operator rig expenses. Helicopter transportation is typically the most efficient and often the only form of transportation to drilling and production platforms,

- Industry-leading safety record. Safety is a top priority in customer purchasing decisions. CHC maintains an industry-leading safety record with a 5-year rolling average of 0.38 accidents per 100,000 flight hours vs. an offshore industry average of 1.8 accidents.

given growing distances from shore and adverse weather conditions. Crew changes every 7-14 days are often mandated by regulation or collective bargaining agreements. In addition, deepwater development plans are generally premised on longer-term commodity price assumptions and less sensitive to short-term commodity price volatility. As a result, the Company enjoys relatively stable demand through 3- to 5-year contracts and a 90%+ historical retention rate. Over 70% of CHC’s contracted revenue is derived from fixed monthly charges (not determined by hours flown) while fuel and other variable costs are typically passed through to customers.

- Strong competitive differentiation. The industry is characterized by requirements for high capital investment and stringent licensing and technical certifications. Heavy helicopters typically cost $25-30 million. The majority of the Company’s helicopters are latest generation, reflecting a significant upgrading campaign over the last several years that lowered the average age of the fleet from 15 years in 2008 to 11 years today, and just under 6 years on a value-weighted basis. The Company’s MRO business provides further competitive advantages through supply chain flexibility, faster turnaround times and a third-party revenue stream. Recent investments in a global operations center and supporting operating systems have driven best-in-class operational reliability.

- Attractive valuation and deal structure. CD&R’s investment implied an entry valuation of 6.8x EBITDAR. CD&R acquired a dividend-paying convertible preferred security and has significant governance controls.

-

- Importantly, CD&R believes that the Fund IX equity investment provided a positive catalyst for CHC’s operating profile and valuation by reducing leverage approximately 45% (23% on a lease-adjusted basis) and providing the Company with the flexibility to take a more offensive approach to growth and financing opportunities.

- Substantial governance rights. Fund IX is CHC’s largest shareholder and, as of closing, owned (on an as-converted basis) 49.6% of the Company, with such ownership increasing over time to the extent the Company pays Fund IX’s preferred equity dividends in-kind. Similar to CD&R’s prior partnership investments such as Diversey, Sally Beauty and Univar, where CD&R funds owned 40-50% of the respective company at closing, CD&R has pro rata board representation rights, in addition to the right to appoint

- the Company’s Chairman and maintain consent rights over key personnel decisions and significant capital structure and M&A activities.

- Strategic optionality. With its global footprint, CHC has both organic and inorganic growth prospects.

Looking Forward

CHC is focused on navigating the current oil price environment by strengthening alignment with its customer base, reconstituting and high-grading the management team, and driving operational efficiencies within the organization.

- The Company is actively engaged with customers to help manage costs with an absolute commitment to best-in-class safety and operating performance

- The Company is focused on reducing expenses (on a regional and corporate level), organizational delayering, centralizing operations and reducing its lease and interest expense

- CHC is rationalizing non-essential capital spending while focusing on enhancing fleet utilization and continuing to optimize its fleet mix

The long-term demand drivers for deepwater and ultradeepwater exploration and production remain robust, and CHC expects to capitalize on the eventual market recovery with a stronger balance sheet, improved fleet mix, best-in-class operating performance and a more efficient organization serving its customer base.

Investment Characteristics

| Investment Period: | December 2014 - Current |

| Industry: | Transportation Services |

| Seller: | First Reserve and Public Shareholders |

| Net Purchase Price: | $3.3 billion (lease-adjusted) |

| Purchase Multiple: | 6.8x LTM 10/31/14 EBITDAR of $495mm |

| CD&R Equity Investment: | $400M (Fund IX) plus $200M of LP co-investment |

| CD&R Equity Ownership (at acquisition): | 49.6% (including LP co-investors) |

| Adjusted Net Debt to EBITDAR (at acquisition): | 4.4x 10/31/14 EBITDAR of $495mm |

| CD&R Operating Partner: | John Krenicki |

| Status: | Private Unrealized |

| Website: | www.chc.ca |

Summary Financials

| Fiscal Year Ended April 30, | |||

| (millions) | 2013 | 2014 | At Acquisition 2015 |