-

NCI operates in three segments: (1) Engineered Building Systems, (2) Metal Components and (3) Metal Coil Coating.

NCI operates in three segments: (1) Engineered Building Systems, (2) Metal Components and (3) Metal Coil Coating.

Collaborated with management to orchestrate an operational and balance sheet restructuring that enabled NCI to weather the decline in non-residential construction activity, grow revenue and profitability and position the company to benefit from rebounding end-market demand

As the recession began in early 2009, NCI faced two nearly crippling market dynamics: (1) a decline in demand of over 60% as nonresidential construction activity ground to a halt in North America and (2) a decline in steel prices that left the company with expensive inventory and no ability to pass through that cost in pricing. As earnings fell dramatically in the first quarter of 2009, NCI also had to confront the prospect of potential bankruptcy

due to the looming threat of a convertible bond that could be put to the company at the end of that year. The company needed fresh capital and an operational overhaul that would right-size the business in the near term, while positioning it to grow when the market recovered.

CD&R helped the management team define and execute a long-term, value-building plan. On the operational side, the restructuring included reducing manufacturing facilities from 38 to 26 and reducing headcount. Total indirect and direct variable costs were reduced over 42%, while sales and service levels were maintained. Simultaneously, CD&R led a recapitalization of NCI’s balance sheet that included CD&R Fund VIII’s $249 million preferred equity investment

-

and, through the investment and negotiation with the company’s term loan holders and bondholders, created a new capital structure with long-dated maturities, substantial liquidity and no meaningful financial covenants.

The NCI investment reflected a number of attractive risk-reward attributes: senior equity position in a low leverage, covenant-lite capital structure, a dividend-paying security, operational control and the ability to convert into common stock to capture the upside in equity value creation over time. In May 2013, CD&R Fund VIII subsequently converted its NCI preferred shares into common shares.

Key Achievements

- Rationalized manufacturing facility footprint by 25% and reduced headcount, together generating $120 million of annualized fixed costs savings

- Delayered the sales organization and centralized certain key operations, such as manufacturing and supply chain

- Centralized engineering and drafting and made IT investments to automate work, increase standardization and maximize efficiency

- Grew and diversified the customer base, particularly in the Coatings Group, which added customers that do not purchase directly from steel mills

Company Profile

NCI Building Systems is a leading integrated manufacturer, marketer and distributor of steel building products primarily for the low-rise, non-residential construction industry. NCI goes to market with multiple well-established brands, competing across a broad range of geographies and end-user markets, including industrial, commercial, institutional and agricultural. The company operates 43 manufacturing and distribution facilities across the United States, Mexico and China, with additional sales and distribution offices throughout the United States and Canada as well as satellite sales locations in certain non-U.S. jurisdictions. The company’s broad geographic footprint and hub-and-spoke distribution system enables it to efficiently supply and support a broad customer base that includes contractors, developers, manufacturers, distributors and a network of over 3,200 authorized builders across North America. NCI operates in three segments:

-

- Engineered Building Systems (“Buildings”) — designs, engineers, manufactures and markets engineered metal building systems;

- Metal Components (“Components”) — designs, manufactures, sells and distributes components such as metal roof, wall systems and insulated metal panels for a variety of new construction applications as well as for repair and retrofit uses; and

- Metal Coil Coating (“Coaters”) — cleans, treats and coats hot roll and light gauge metal coils for various applications by external customers and internal use by the other business segments.

Value-Building Initiatives

Nonresidential construction activity remains near historical lows, with nonresidential starts of approximately 940 million square feet in 2014 according to McGraw-Hill.

Key Achievements, cont.

- Expanded high-margin and fast-growing insulated metal panel product offering by bringing online two new manufacturing facilities and completing two strategic acquisitions

- Completed secondary offering in January 2014, which together with prior cash dividends, have returned 79% of Fund VIII’s original investment; Fund VIII continues to own 56% of NCI1

Prior to the current downturn, the four most recent troughs of nonresidential construction starts since 1967 averaged over 1 billion square feet, and the overall average over this period was approximately 1.29 billion square feet per year. CD&R and the NCI management team have identified and executed several initiatives to right-size the business to operate efficiently and profitably during the downturn and

to position the company to grow as the market recovers in the coming years. Some of the initiatives the company has executed and continues to pursue are aggregated into the following broad categories:

- Streamlining and manufacturing reorganization. Reorganizing manufacturing operations and consolidating under one leader (John Kuzdal). Delayering organization (8 levels to 5) to improve communication, decision making and accountability. Implementing new standards and procedures for production control and process engineering to manage scheduling and eliminate bottlenecks.

- Customer service focus in Components. Reorganizing sales territories and increasing emphasis on customer responsiveness to drive customer satisfaction. Leveraging technology to implement CRM system, self-service touch points and online customer ordering.

-

- Optimization of buildings design and processes. Streamlining operational flow to eliminate scheduling conflicts, release date issues and irregular production balancing. Consolidating online detailing / drafting programs to eliminate manual drafting. Increasing standardization of building system components

- to maximize efficiency of hub and spoke manufacturing and distribution network.

- Strategic growth opportunities. The company is exploring both organic growth initiatives and selectiveaccretive acquisitions. The acquisitions of Metl-Span, a leading manufacturer of insulated panels, and CENTRIA, a leader in architectural insulated metal panel wall and roof systems, were completed in 2012 and 2015, respectively, and position the company to further penetrate an attractive, growing market with sizeable incremental revenue and cost synergies achieved through integration planning and sharing of best practices. NCI opened its Coatings facility in Middletown, Ohio in late 2012, which extended the company’s market coverage into the upper Midwest and Northeast regions of the United States.

- Organic growth initiatives are in various stages of progress and include a continued effort to market and efficiently produce low complexity pre-engineered express buildings, expand furnishing and erection capabilities and grow in new markets and with new customers.

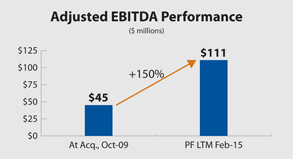

PF LTM Feb-15 adj EBITDA reflects CENTRIA acquisition as if it had occurred on the first day of such period.

PF LTM Feb-15 adj EBITDA reflects CENTRIA acquisition as if it had occurred on the first day of such period.

-

Looking Forward

McGraw-Hill and other industry sources are forecasting continued improvement in the nonresidential construction market, and NCI is focused on capitalizing on that recovery. Based on industry indicators, backlog levels and quoting activity, the company expects significant growth over the next several years. NCI will also benefit from company-specific growth initiatives and continued improvement in pricing discipline, manufacturing efficiencies and operating leverage. Following a successful secondary offering in January 2014, we expect to continue the public exit process as the Company rebounds to historical levels of profitability.

Investment Characteristics

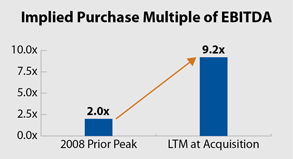

| Investment Period: | October 2009 - Current |

| Industry: | Steel Building Products |

| Seller: | NCI Building Systems, Inc./ Public Shareholders |

| Purchase Price: | $412M |

| Purchase Multiple: | 9.2x LTM Adjusted EBITDA of $44.6M |

| CD&R Equity Investment: | $249M (Fund VIII) - Preferred Equity |

| CD&R Equity Ownership: | 68% (at acquisition) |

| Net Debt to EBITDA (at acquisition): | 1.1x |

| CD&R Operating Partner: | Jim Berges |

| Status: | Partially Realized - Publicly-Traded |

| Website: | www.ncibuildingsystems.com |

Summary Financials

| Fiscal Year (Ended October) | ||||

| ($ in millions) | At Acq. 2009 |

2013 | 2014 | LTM Feb. 1, 2015* |